As a home owner, I’ve seen various methods of estimating annual home maintenance costs. These methods involve calculating a percentage of your home value – usually between one to four per cent, and using that value as the annual maintenance estimate.

Being a bit of a skeptic, I never had much faith in these estimation methods, since there is never any kind of logic to them or analysis supporting the numbers.

It doesn’t make sense to me that your home value should determine maintenance costs, especially if you live in an area where the land value is the majority of your house value. The cost of maintaining your land is far less than the cost to maintaining a house.

Another problem with these estimates is that a poorly maintained, older home will be worth less and consequently have a lower estimated maintenance cost than a new, well-maintained house – clearly this makes no sense at all, since the poorly maintained house will likely need more maintenance and should have a higher estimated maintenance cost.

A third issue is that from a budgeting perspective, home maintenance often involves high cost items that occur infrequently. For example; a $12,000 roof that lasts roughly 20 years. Calculating an annual cost for that roof might be an interesting exercise, but it’s unlikely to actually help you efficiently budget for it. And will you still be living in that same house 20 years from now?

A better way to calculate your home maintenance costs

A better method is to look at the major components of your house that will need replacing at some point and do the following steps for each component:

- Estimate the replacement cost

- Determine the life expectancy

- Determine the current age of each item

- Calculate the estimated remaining life expectancy

- Rank the house components in order of increasing estimated remaining life expectancy and then plan for any expenses expected in the next five years.

- Watch for any upcoming “expense clusters” – A high amount of maintenance costs in a short time period

Let’s do this exercise for my house

First I will list all the big items in my house that will need replacing at some point:

- Gas stove

- Refrigerator

- Dishwasher

- Dryer

- Washing machine

- Deck

- Furnace

- Air Conditioner

- Gas water heater

- Roof

- Gutters

- Windows

- Fencing

The next step is to determine the estimated life spans.

Here is a source for the life expectancy of home components which has good data.

Then we find out the current age of each component.

The current age of most of my items was fairly easy, since a lot of them were replaced just after buying the house. For older items, you can often look on the component itself to see if there is a date on it. Windows, furnaces, air conditioner, hot water tanks should all have a date on them somewhere.

If you don’t know the age of an item, just take a guess. For example if you bought your house 12 years ago and haven’t replaced the roof, there is a very good chance that the roof is at least 12 years old. 🙂 If the roof isn’t falling apart or leaking, it’s probably less than 20 years old. Pick a number halfway between 12 and 20, say 16 years and there’s your estimated roof age.

Now we need to figure out the replacement costs.

This can be difficult since there can be a wide variety of options when replacing an item. I wouldn’t worry about trying to get accurate figures – for this exercise, any reasonable guess will do. Once you get close to replacing a component, then you can worry about the exact cost.

Check here for some cost estimate guidelines.

If you are really clueless about how to collect any of this data, see if you have a copy of the original inspection report which should contain some of this information. A more expensive option is to hire a home inspector to check out your house – they can give you an idea of the condition, age and replacement cost of the various parts.

Calculate “Remaining life expectancy”

Finally, I need to calculate the “Remaining life expectancy” for each item by subtracting the current age of each item from the life expectancy. For example if my roof is 14 years old and the life expectancy is 20 years, the “remaining life expectancy” will be 20 minus 14, which is six years.

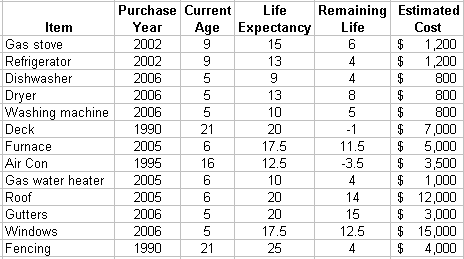

Here is a table showing all my major maintenance costs, ages and life expectancies. Note that I put in a “purchase year” for each item, so that I can look at this table again in a few years and the current age (calculated) will be automatically updated. Most of my estimated costs are very ball park.

Just for fun, I took all the items, calculated an individual annual cost and summed that up to get an idea of my average annual maintenance costs. It came out to $3,186 per year. Throw in a few bucks to cover smaller maintenance costs not listed and my annual house maintenance costs are $3,500 per year. But as we’ll see later, that annual figure is not very useful for planning or budgeting.

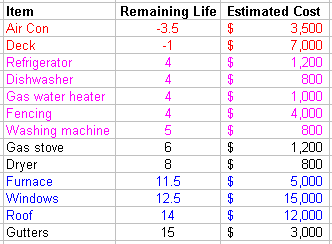

Now that we have all the data we need – let’s rank all the items by the remaining life expectancy so we can get an idea of upcoming maintenance expenses by time period.

I suggest that you focus on the next five years only. Beyond that is just too far in the future. Most single maintenance items are not so expensive that five years isn’t enough to save up for them.

Look at any expenses in that five year time period and think about how you can plan for them. If your budget is tight and you need a furnace in four years, setting aside some money each month might be a prudent idea. On the other hand, if you have a high savings rate and a decent emergency fund – perhaps you can wait until closer to the actual replacement date to save some cash or even just buy on credit and quickly pay back the loan. The estimated life expectancy dates are not very accurate, so you don’t want to have $5,000 cash sitting around waiting for a furnace to die, if you have better uses for that money.

It’s also worthwhile to look beyond five years for the case where there are a lot of items up for replacement at the same time (“expense cluster”). This situation could require more advance planning (which could include moving). This might happen where someone moved into a new build home or did major renovations.

Ok, let’s get back to my case study:

I’ve ranked the items by the expected expiry dates. While I’m mainly going to focus on items that need replacing in the next five years, I’m also going to note the “expense cluster” that I’m going to face in about 12 years.

Now I will look at the list and do some planning.

These two items are overdue for replacement:

Air conditioning – This item is old and could die any minute. However, it works fine and I’m not planning to replace it until it stops working. Because of our emergency fund and high savings rate, the $3,500 replacement cost will not be an issue. Action plan: Monitor indoor air temperature on hot days.

Deck – My deck might actually be a funny story if it belonged to someone else. It is ancient – I’ve estimated it’s 21 years old, but it could be 50 for all I know. Every year I replace a couple more rotten boards. The reason I haven’t replaced the deck is because we have water problems with our basement that will be addressed in the future. There is no point in getting a new deck if we might need to dig up around the house for water proofing. When we tackle the basement project, a new deck will be included in the budget at that time. Action plan – Keep rebuilding deck one board at a time.

The following items are due for replacement within the next five years:

Refrigerator, dishwasher, gas water heater, washing machine – These items have a total replacement cost of almost $4,000, which is not a worrisome amount. Given that the estimated expiry won’t happen for at least four years, I’m not going to worry about these expenses at this time. Action plan – Nothing.

Fence – This is another item I have no idea of how old it is. It’s not in bad shape and the reality is that I will probably just do small repairs if it starts having problems. It’s extremely unlikely that the fence will get replaced anytime in the next ten years. Action plan – Don’t lean on fence.

All the remaining items have expiry dates that fall outside of my five year window of concern, so they will be ignored for now. I will take note of the last four items in the list – furnace, windows, roof and gutters. These items represent $35,000 of costs within a 3.5 year window. This is what I was referring to when I mentioned the idea of an “expense cluster“.

This expense cluster will eventually require some planning, but it’s still too far off (11+ years) to plan for now. It’s likely that we’ll start saving an extra $5,000 per year starting a year or two before the cluster hits in order to be able to pay for those expenses.

This exercise shows why an annual maintenance estimate is not very useful. In my case, I don’t have a lot of costs coming up in the next several years, so if I saved $3,500 per year – that cash would be sitting around doing nothing. I’d much rather put it into my mortgage. Conversely, if you have a house where there are a lot of upcoming expenses, the $3,500 per year budget probably won’t be enough.

Conclusion

Because I have a decent emergency fund and a high savings rate, I don’t need to do any kind of special budgeting for house maintenance now, since I don’t have a lot of costs coming up in the next few years. Someone with a tight budget might have to set aside a “house maintenance” fund to handle these costs.

Every house will be different – It’s important to analyze the components of your house in order to plan out your future house maintenance costs.

Some more thoughts

This concept of future budgeting can include items other than house maintenance items. If you are planning/hoping for renovations in the future – add them on the “maintenance calendar” as well. Even big ticket non-house items like new cars, “trip of a lifetime” vacations can be added in.

Specific budgeting for future items is not always practical. If you just bought a new roof for $10,000, are you really going to start saving $500/year in a “roof fund” for the next 20 years? That’s just not a good use of your money.

One of the best ways to deal with future expenses where it’s not certain about the timing is to have an emergency fund and a high savings rate. Anything you can do to improve your current financial position will help you deal with future expenses.

Problems with using percentage of home value estimates with examples

Land value skews the estimates

As I discussed in this post; How to value real estate, the land value can make up a majority of a house purchase price. Especially in an urban setting.

Using a percentage estimate for a maintenance budget means that a home owner in a popular area will have a higher maintenance estimate than someone who lives out in the country and has a lower land value.

For example – Take a two-story 1,200 square foot house. Let’s say the house value (not counting the land) is $150,000. If this house is sitting in an expensive area of Toronto, the total value might be $700,000. If the house is out in the country, perhaps the total value is only $200,000. If we use a maintenance estimate of 2% of the house value, that gives us $14,000 per year for the big city house and only $4,000 per year for the country house. Given that this estimate methodology gives us two very different results on identical houses indicates that it’s quite flawed.

Older, crappier houses will negatively influence maintenance estimate, but probably need more maintenance.

If we ignore land value, a house that is in great shape will be worth more than a run-down house that needs lots of maintenance. The percentage estimate will incorrectly conclude that the run-down house needs less maintenance, which is nonsense.

Example – Let’s take our $200,000 country house which is made up of $50,000 land and a $150,000 house. This house is very well maintained. Let’s say there is a very similar house on the adjacent lot, except this house is much older and hasn’t been well maintained. The second house is only worth $150,000, which is made up of $50,000 land and a $100,000 building value.

The percentage estimation method will tell us that the well maintained house should have an annual maintenance budget of $4,000 (2% of $200,000), but the run-down house only needs $3,000 per year (2% of $150,000). This is clearly incorrect, since it’s very likely that the cheaper house will need more maintenance.

How do you budget for home maintenance? Anyone else miss the good old “rental” days?