If there is one thing I can’t stand is doing taxes. I’ve always done my own taxes and although it wasn’t too much of a chore when my financial situation was simpler it was still a pain. Now I have investment income, investment sales, a small business and things are a lot more complicated than they used to be. Of course once I finish my return this year I’ll be thinking “that wasn’t so bad” but the problem is that by the time I do my next year, I’ll have forgotten too much info and the process will be painful once again. This is one of those tasks that if you did it monthly, it would be a lot easier to do.

Please note that Canadian QuickTax is now called TurboTax

I decided to use QuickTax Business edition this year – at one time the idea of paying $40 for fancy software just wouldn’t have happened, but now I value my time far more than money so I don’t mind paying a bit extra if it will make the tax return easier.

Why don’t I use an accountant you might be asking? Well, I don’t know – I had thought about it this year but one of the problems I have with an accountant is that I still have to do all the bookkeeping tasks in order to give the proper info to the accountant. I don’t have an accountant so I have to go through the process of finding one. It might happen still but not this year.

I had been using a cheap efiling program for the last few years which was basically the electronic equivalent of using paper forms. In other words – no help at all. I was always skeptical of claims about products like QuickTax and TurboTax (American equivalent) that they could “help” you with your return.

I have to say that I was quite amazed with TurboTax. Basically you go through the screens filling in appropriate data. If you need help or clarification at any point then you can branch off onto a different set of help screens.

One of the main advantages I found with QuickTax over the simple program I used to use is that you don’t have to know anything to use QuickTax. For example if you made RRSP contributions and want to record them on your tax return then you need a schedule 7 form. With my old program, I had to look that up and ask the program to load that form before I could enter the info. With QuickTax, it asked me during the process if I had any RRSP contributions and then provided boxes to fill in. Same thing with dividend income, interest income, interest expenses, business income and expenses.

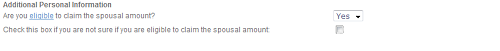

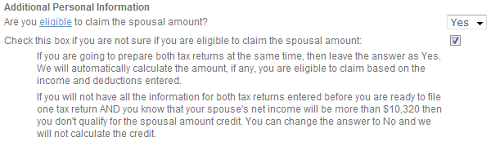

An example of the type of help

I thought I would show exactly the kind of help you can expect. At one point in the return it asks you if you are eligible to claim for the spousal amount. There is a little check box in case you don’t know if you are eligible or not.

If you don’t know what the spousal amount is or whether you are eligible for it then click the box and you get a pretty good explanation of the spousal amount.

Drawbacks of QuickTax

I was very impressed with some of the features of QuickTax – the help function and interview process is a huge benefit for someone who is filing taxes for something they haven’t done before (ie new business) or haven’t filled out many tax returns.

The problem is that if you do know what you are doing then the interview process gets very cumbersome, very fast. In my case I have struggled with a simple tax return program for the last couple of years, but I have learned all the forms I need and how to fill them out. After a while I realized that I would be better off with the old program and decided to give up on QuickTax. It’s a great software package but it’s just not useful if you know what you are doing.

I also haven’t given up on the accountant idea either – one of the things that came apparent with the QuickTax interview process is that there are quite a few questions that I need answered regarding my business (incorporation?) and even dependents – are kids dependents for tax purposes?

QuickTax versions

For the record, if you don’t have a business then there are lower priced options – in fact there is a free option but you need to have a fairly low income to qualify. The cheapest version for most people is the online $15 version which should be pretty good. The premier version will cover things like investment moves and the business edition will handle your unincorporated business. There is also a corporation business version but I doubt very many people with corporations will do their own taxes.

Online or desktop?

I was planning to get the desktop version (the one you download to your computer) but the cost was $100 whereas the online version was only $40. Pretty easy choice.

What do you use to do your taxes? Does anyone else with a business do their own taxes?

17 replies on “QuickTax Canadian Tax Software Review – Get 10% Off”

I’m back to doing my own taxes this year. We had a complex situation two years ago and I had the accountant who does our company taxes to handle it. Last year they made two major errors on my wife’s taxes even though I had included explicit information about atttribution of accounts along with the copious bookkeeping I had done on our investments. I figure I can screw up for much less than the $270 they charged us.

Why would you use the interview process in Quicktax? Just choose the forms option, it is way quicker.

Jambo, I didn’t see any ‘forms’ option but I’ll take another look.

Hi Mike,

Geoff here from the QuickTax team. Thanks very much for the review; we really appreciate the feedback, and our development teams review much of it as we work on future versions.

One note:

It sounds like you?re comfortable using forms. The desktop versions of QuickTax (but not QuickTax Online) come with electronic versions of the government forms built in, and you can toggle between the forms and the interview. Only QuickTax offers both the forms and interview options. A small percentage of our customers use the forms exclusively. Many people do flip back and forth between the two, and most use the interview exclusively. The majority of Canadians want to be sure their taxes are accurate and they?re maximizing their refund, and the interview is the best method for many.

Cheers,

Geoff

(My contact info?s located here: http://www.intuit.ca/en/intuit/media_index.jsp)

Thanks Geoff.

I loved the interview process. However when I went back to enter info I had missed then it was difficult.

RE: Children as tax credits.

From the current (2010) federal TD1 form:

2. Child amount ? Either parent (but not both), may claim $2,101 for each child born in 1993 or later that resides with both

parents throughout the year. Any unused portion can be transferred to that parent’s spouse or common-law partner. If the

child does not reside with both parents throughout the year, the parent who is entitled to claim the “Amount for an eligible

dependant” on line 8 may also claim $2,101 for that same child.

This was introduced about 3 years ago now.

I believe, also, that if you don’t have a spouse (for claiming the spousal ammount) you can also claim a dependant/child as ‘equivalent to spouse’ for the purposes of getting a double dose of the basic personal amount.

Obivously you’d still want to check all this out with someone who knows (or figure it out yourself from the Income Tax Act – Lol?) before claiming credits based on “this random comment on my blog told me I could….” 🙂

Keep up the great work, I really enjoy the blog.

Doh, forgot I was going to put a plug in for my favorite, studiotax (http://www.studiotax.com/). I’ve got no affiliation, but free is great, and I’ve found it works well. Obviously not quite as simple (doesn’t use the interview process), but still works extremely well.

Thanks David, I wasn’t aware of the child credit. I’ve looked up many times if you can claim your kids but I keep ending up at the CRA dependent page which isn’t the same thing.

While this is good news it means I have refile (or whatever) for 2007 and 2008. Hopefully that isn’t too much work.

So much for these stupid tax programs, I was better off with the documents!!

[…] Four Pillars does a Quicktax Canadian Tax Software Review, which would be useful if someone gave away the software (like I […]

[…] on QuickTax and UFile, two of the more popular programs for Canadians. Four Pillars had a review of QuickTax as well. From what I’ve heard, these programs are quite comparable and your choice may come […]

I used Quicktax for about 10 years, however I will opt out this year as the cost format has changed to a per return price. I used to look forward to purchasing a hard copy and be able to do more than one return for the price of the software. Now that I will be charged a per return rate I am going to use one of the free programs offered and save myself the $30 per return fee.

@Kevin –

Geoff here on the TurboTax team. The desktop version of TurboTax is still the multi-return version you’re used to. We’ve added more returns to the Premium and the Home & Business editions, but the price remains the same.

The online versions of TurboTax are and always have been a per-return version (although we’ve introduced lower prices for multiple online returns).

Cheers, Geoff

Question about reporting stock trades.

I do a lot of stock trading (100 ++ per year). In the past I’ve calc. my ACB and then given that info to my accntant. Does your premium version Turbo Tax provide me the forms I need to show CRA all my trades and how I arrived at my ACB? Thanks.

Hi VR, Geoff here from the TurboTax team. Short answer: Yes, it does. The desktop version of Premier is likely the best version for you. Longer answer: It sounds like you’re looking for the Schedule 3 supplementary worksheet in TurboTax. The Schedule three itself shows about eight lines available (minimizing the amount on the screen), but the supplementary gives you an additional ~80 lines, all of which roll up into your Schedule 3. Of note, if you have 100s to input, you can combine multiple items on a line – the CRA expects this and is fine with it.

NB: I check in here fairly regularly, but you’ll likely get a faster answer through our Facebook or Twitter links:

facebook.com/TurboTaxCanada and @turbotaxcanada

Cheers,

Geoff

I have been a user of QuickTax and now TurboTax for 10 years or more.. and in most instances have been happy with the software, particularly the carry forward of information from the previous year, the ease in netfiling and quicker refunds in the bank.

I was sort of disappointed this year with the software because my personal circumstances were financial substantial in that my income was drastically reduced. ie Gross Income reduced to $ 16,750 but i had a number of deductions that the software did not help me in assessing whether to hold onto and carry forward til my income was back to normal.. I had to experiment and complete 3 different returns to determine what i needed to do to get the maximum return and tax benefit for this year and for next.

Im starting to wonder know with my children’s past returns, their tuition costs and deductions were improperly claimed when they should have been carried forward.. I may now need the help of an accountant to look at past returns.

@ Randy – Geoff here with the TurboTax team. We can help – our Free Tax Experts are on call to walk through any scenario with you. They’re available 24/7, by phone or internet chat. These are people with years of Canadian tax experience in every province & territory.

The Free Tax Advice icon in the bottom right of TurboTax will take you to us.

g

Hi and thanks to all for their comments. I’m considering a change from Cantax to something else this year. I’m only doing 3-4 returns now so I don’t need the full-blown version. Can anyone give me some pros and cons of switching from Cantax to something else? I don’t want to spend huge amounts of time learning something new or cumbersome. I do need forms for multiple businesses, farms, investments, etc. I’m looking to reduce the amount I’m spending. Cantax is currently charging 140.00 plus taxes for the 15-return version. I hope it’s ok to mention brandnames and prices here. Not sure what your rules are. Thanks for any help! Mim