Scott Adams writes some of his business ideas on his blog, and he says people react in one of two ways, they tell him either: it’ll never work dumbass or someone’s already doing it dumbass (and they provide a link). Both are valid reactions to any of my business ideas ![]() .

.

A few years ago MBA programs were all the rage (they’re still popular today, but the market has been flooded with MBAs). They’ve introduced a variety of flavours (executive MBA, part-time MBA, etc) to cater to the needs / desires of various workers. In every case the value proposition is the same: this program will improve your business skills (and from this improvement, make it easier to find work and move up the ranks at a company). Businesses were convinced of the value enough that they have sometimes paid to send top employees.

One problem, for the school, is that students take the course and leave (no repeat business). You hope that students are happy enough with what they’ve learned that they recommend the program to others (and evangelize it in their workplace), but a school is unlikely to get the same student a second time.

This idea would be a program, put together at a school offering an MBA, that runs for a pool of employees for a short period (perhaps for one week) annually. The school would put together a variety of classes and events, designed for employees at a specific level in an organization. Each year would have SOME tailoring to the current business climate, challenges facing the companies industry and company specific problems, but would also focus on fundamental business skills (it wouldn’t be a week of learning how to attach cover pages to TPS reports). Kinda like summer camp for business people (with catered lunches replacing hot dogs, and lectures on how the subprime meltdown or stimulus payments will affect their industry replacing canoeing).

The value to the employee should be obvious that they’ll learn some specific skills, make them better at their current job, and potentially get some “bullet points” to add to their resume

The value to the company is, in part, that they’re strengthening their work force without losing employees for months like they would to a standard MBA (it also “protects” them from meeting people who will work at other organizations and may try to hire them away). The other value is that a group within the organization will all be exposed to the same ideas, and ideally would then be able to reinforce each other if they tried to enact change within the company based on what they’d learned.

The real (hidden) value would be employee retention. Such a program would be useful for identifying the future leaders within a company and making it clear who they are (the ones sent to this every year). This would be useful for the employees themselves (to show them the company recognizes their future potential and is investing in them and grooming them for greater responsibility), for their co-workers (to learn who they might be working with after future promotions and start getting to know them) and for these people’s supervisors (the company is signalling that they’re an important resource and not to mess with them).

For a large organization, multiple groups at different levels could be sent at different times. For a smaller company (that wouldn’t have enough employees to fill out this sort of program), they’d probably be better focusing on this type of thing in-house.

For the school itself the clear benefit would be that the programs would continue indefinitely, with potentially multiple groups going through every year if the school could convince the company of its value. The school should be able to reuse its faculty, facilities and resources to pull together a curriculum cheaper and faster than the organization itself could do in house.

For this post, or any other of the wacky business ideas I post, obviously I’m releasing any ownership claims I may have over these ideas. If you like something I post and feel like you can make money from it, please feel free to do so! Let me know when you’re opening and we’ll do a post on it to give you some free advertising.

I’m a big fan of inline skating – or “roller blading” as I like to call it. I got my first pair of skates which were the original Rollerblades back in the mid-80s. Rollerblade was the original inline skate company and I had to order them from somewhere in Quebec. It wasn’t until probably the 90’s when they became more mainstream and other sporting good companies got in on the act.

I’m a big fan of inline skating – or “roller blading” as I like to call it. I got my first pair of skates which were the original Rollerblades back in the mid-80s. Rollerblade was the original inline skate company and I had to order them from somewhere in Quebec. It wasn’t until probably the 90’s when they became more mainstream and other sporting good companies got in on the act. Mike and Trent are in Las Vegas and Mike has just lost a hand of blackjack after Trent advised him to double down.

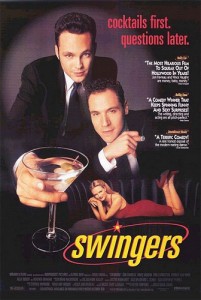

Mike and Trent are in Las Vegas and Mike has just lost a hand of blackjack after Trent advised him to double down.