I’ve commented before about how dangerous it is to give investment advice to friends and family. I keep running into people who are very bright individuals in other areas of their life, but just throw up their hands in frustration and give up when it comes to managing their money. Never one to learn from my experiences, my goal is to put together a couple of posts, one on easy to understand and set up investment strategies and the other on investing strategies to avoid unless you REALLY know what you’re doing.

Short Investing Horizon

If you had a chunk of money sitting around that will be used for something within the next 5 years, your priority should be capital preservation (not losing it!). A post a while back on Canadian Money Forums asked about investing $15k for 2 or 3 years, and the consensus seemed to be that for this short a time frame GICs or high interest savings account are the best place to put it. I agree wholeheartedly.

If a person with a lump sum of money to invest for 2 or 3 years has any debt (even a mortgage), I think an even better use would be to pay down the debt. It should PROBABLY be possible to borrow it again (assuming a decent credit rating) if the money is needed after a couple of years, plus you’ll have avoided all the interest that you would have paid in that time period (which I can guarantee will be higher than the return on a GIC or savings account).

10 Year Investing Horizon

If you won’t need the money for at least 10 years (usually this is for retirement funds) things get interesting. Equities (stock) are more volatile (meaning they can move up and down unpredictably). Obviously people prefer a guaranteed return, not an uncertain one (and prefer to make money, not lose it), and therefore equities offer a greater LONG TERM *AVERAGE* return than GICs or a savings account. To capture this higher return you need to stay in the market for longer lengths of time, to catch the periods when the market does really well (to make up for the times it does very poorly). The longer you stay invested, the closer you should be able to get to the long term expected return (which should be around 7% by some measures).

Rather than picking specific companies, these strategies focus on asset allocation. Read over these short descriptions, pick the one that sounds most interesting. Spend an hour or two reading the links in its description and you should be good to go!

Couch Potato Portfolio

MoneySense magazine has what they call the couch potato portfolio (based on a US version by Scott Burns). The idea is an intensely simple portfolio that takes minimal time or thought to maintain (they estimate 15 minutes per year and no investing knowledge required). The core idea of this is a portfolio that has very broad diversification. It is broken into four components, and each year these are “re-balanced” so that they will be worth the same amount.

e.g. say you put $100 in A, B, C and D . At the end of the year A is worth $120, B and D are worth $110 and C is worth $80, you would buy and sell until you had $105 in each of the components and they’re “balanced” again.

There are SLIGHT differences in what you choose for your four components, but it’s not worth getting too hung up on. If you want to get started with retirement savings but keep putting off “figuring out investing” and never get around to it, picking a couch potato portfolio and getting started would probably be very worthwhile.

In addition to the information at the MoneySense site, the Canadian Capitalist has summarized the portfolios.

Sleepy Portfolio

The Canadian Capitalist took his inspiration from other lazy portfolios and created the sleepy portfolio (a “fire and forget” portfolio for large sums of money, if you get a surprise inheritance this might be a reasonable place to dump it) and the sleepy mini portfolio (for small sums of money on an ongoing basis).

The sleepy portfolio is targeted for young, aggressive investors (so if you only have 10 years until retirement it might not be the allocation for you).

Others

Larry MacDonald proposed the One Minute RRSP Portfolio for those who want the barest of bare bone portfolios (it consists of 2 ETFs with an optional third cash component). Scott Burns, Ted Aronson and the Coffeehouse Portfolio each have their own version of a “lazy” portfolio that’s worth looking at if you have the time and inclination.

If you prefer to get your investing advice from a book and not from yahoos on the internet (why are you reading this blog then? 🙂 ) Unconventional Success by David Swensen, The Smartest Investment Book You’ll Ever Read by Daniel Solin (allocation overview here) and The Four Pillars of Investing: Lessons for Building a Winning Portfolio by William J. Bernstein each contain easy to assemble / maintain portfolios as well as the rationale behind their construction.

How to do it

Once you’ve picked one of the above strategies and read about it, summaries of the the actual asset allocations can be found here (for all except Solin’s and MacDonald’s). Sign up for a discount brokerage account (I like iTRADE / E*TRADE, Mike uses Questrade) and buy the ETFs that make up them up. Wait a year and rebalance. Repeat.

If you’re working with a small amount of money (maybe under $25k), follow Canadian Capitalist’s sleepy mini portfolio (or save in a high interest savings account / GIC) until you’ve got $25K, then move to one of the others.

Keep learning. If you develop a deeper understanding of investing and want to follow a more complicated approach (and manage to convince yourself that it will provide higher returns than passive investing in one of these flavours), then switch.

I touched on

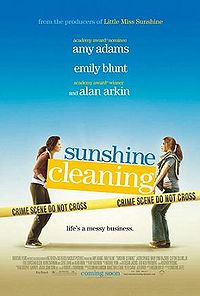

I touched on  Over the weekend I watched, and enjoyed, “

Over the weekend I watched, and enjoyed, “