In this post I’ll be reviewing the budgeting tool called “YNAB” which stands for “You Need a Budget”. There are quite a few financial software tools available on the market such as Microsoft Money (discontinued) and Quicken, so it can be difficult to sort out which tools (if any) are right for you. YNAB is a much smaller company and the software is quite different than the normal all-encompassing money management tools.

I do all my budgets and financial “stuff” on Excel spreadsheets but I’ve been thinking of getting some proper financial software. I have regular bank accounts, a multitude of investment accounts and a small business. I’m doing ok with Excel, I’m thinking that maybe I should upgrade. I’ll be taking a look at various financial software starting with this one.

What is YNAB?

YNAB is a financial budgeting tool. On the simplest level you enter your various transactions into the software and it helps you determine how much money you can allocate to various goals. It also comes with a set of financial rules which are worth reading by themselves if you are learning the basics of financial management. It works on the principal of “zero balance” so that all your income and expenses plus savings have to be reconciled each month.

Here are the 4 “YNAB” rules:

- Give every dollar a job. This isn’t an election campaign slogan – the idea is that if you don’t have a clear goal for each dollar then it will disappear (ie get spent on crap). By assigning ALL your money to one function or the other, there should be less leakage of moola.

- Save for a rainy day. This is basically spreading out a future fixed cost over time so that you don’t get nailed with a large cost one month (ie annual insurance payment) that you might have forgotten about (or ignored).

- Roll with the punches. There is some important flexibilities build into the software so if you do have trouble in a particular month YNAB will make up for it the following month by reducing the budget.

- Stop living paycheck to paycheck. If you are currently living paycheck to paycheck then the software is designed to help you get ahead of your payments so that you have a bit of financial breathing room each month.

You can import data from the YNAB spreadsheet version (not supported anymore) or just start fresh. It also accepts financial feeds from any bank. I tried importing some data from my bank (CIBC) and it worked great.

Who is it for?

I think this tool is mainly for people who are working to get control of their finances and need a bit of help to get organized. If you want to improve your finances and aren’t sure where to start, living paycheck to paycheck and/or trying to get out of major debt then you might want to consider this program. It’s not just a budgeting tool…it’s a way of life. 🙂 Ok, that’s an exaggeration. It really is more than just a financial tool though- it’s almost like a financial tool with an “improve your finances” philosophy built into it.

If you are someone who is at the point in life where you don’t need to track every expense in order to meet your financial goals then this software might not be as useful to you. If your investments are the only thing you want to track then Quicken is probably a better bet. Keep in mind however, that even if you don’t “need” to budget – it can help you achieve your goals quicker even if you are not in debt. One of our goals is to pay off the mortgage and there is no doubt in my mind that we could achieve it faster with a stricter budget.

I won’t be buying this software because it doesn’t meet my current needs – there was a time when I was paying off debts when this software probably would have helped a lot.

I was impressed by the software itself – the original version of YNAB was Excel-based and I didn’t know what to expect with the new software but it is quite good. The creators of this software are very passionate about debt reduction and financial management and it shows on the YNAB site.

How much does it cost?

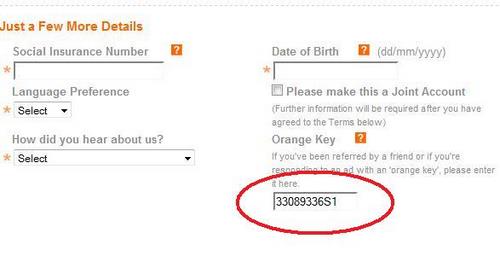

The sticker price is $49.95 but I’ll be posting an offer later on today which will provide a big discount on this price. Check out the “fourpillars” coupon code for big savings.

What doesn’t it do?

It won’t track investments so someone who is more asset-rich might not have as much use for this software.

Guarantee

Along with the 7 day free trial there is a 60 day guarantee on this software so you are pretty safe if you decide you don’t like it.

YNAB 3.0

In November there will be a major upgrade of this software, but don’t worry – if you end up purchasing the existing version (2.0) then you get a free upgrade to 3.0.

Free trial

You can do a 7 day trial if you are interested in checking out the software before buying. Or if (like me) you just want to see what it looks like. Basically you do the normal download and then at the end just click on the “7 day trial”. There is no obligation and you don’t have to give any kind of information to do the trial run.

Here are the 4 different sections of the YNAB system and some screen prints so you can see what it looks like:

Register

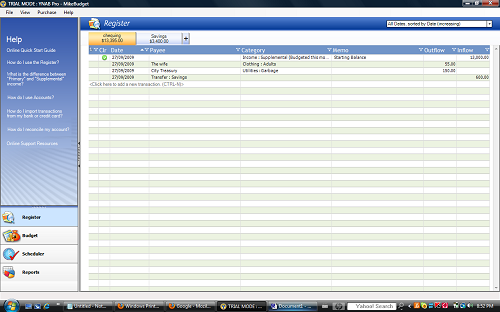

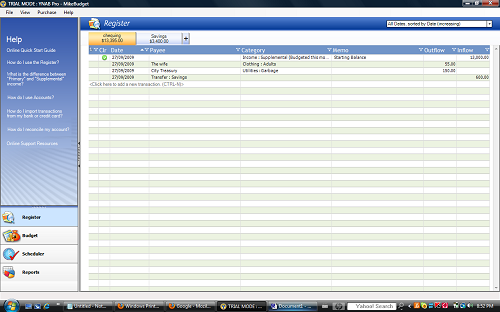

Start by setting up your register – this is a list of all your transactions. First step is to select a bank account or credit card/loan. Then you enter the expenses/income etc within that account. The register is set up like a spreadsheet where the different bank accounts are tabs along the top and you select each account/tab to see the details.

The register screen looks as follows – you can see I’ve set up two accounts by looking at the tabs at the top (checking and savings): Click on the image to see the full-sized image.

You can import data from your bank account quite easily. Just export the database from the online bank account interface and then import using YNAB. I used the “Intuit Quicken” export option since that uses the same default file format as YNAB. If you have set YNAB as the default application for financial downloads (it will ask you on installation) then YNAB will open up automatically with the new data.

Budget

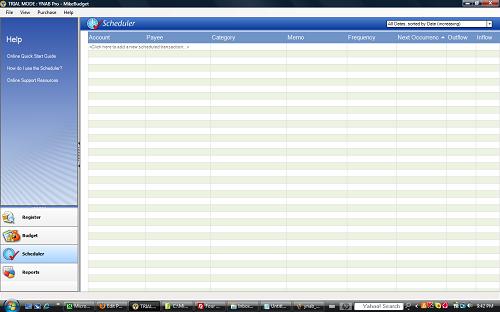

Scheduler

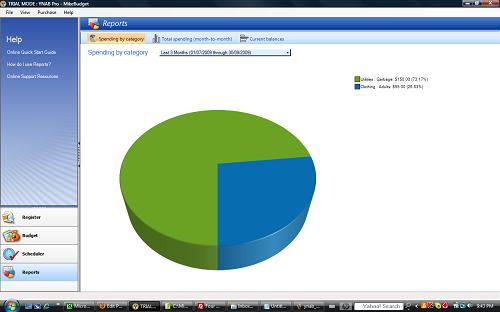

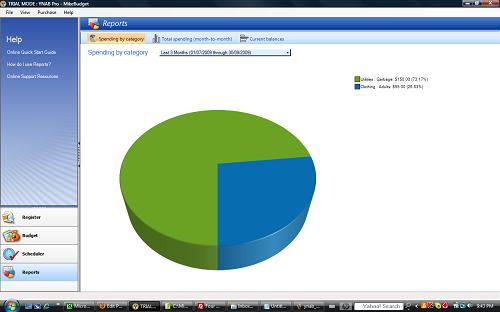

Reports

Google Street View went live today for Toronto, Vancouver, Hamilton, Kitchener, Waterloo, Windsor, Calgary, Canmore, Banff, Lake Louise, Montreal, Quebec city, Halifax. Apparently Saint John NB, Edmonton, Saskatoon and Winnipeg are next on the list.

Google Street View went live today for Toronto, Vancouver, Hamilton, Kitchener, Waterloo, Windsor, Calgary, Canmore, Banff, Lake Louise, Montreal, Quebec city, Halifax. Apparently Saint John NB, Edmonton, Saskatoon and Winnipeg are next on the list.