Most Canadians do their investing with banks or financial advisors. When they want to invest in equities, typically mutual funds are used.

Whether they are high priced or low priced, mutual funds are pretty easy to buy. You just tell your advisor which funds to buy and hand a cheque over. Even if you are a do-it-yourself investor, it’s still easy to buy mutual funds.

Related Article: How to sell an ETF or stock – step by step directions

Buying individual stocks or ETFs (exchange traded funds) at a discount brokerage is an entirely different experience. YOU have to set up the account, YOU have to transfer money to the account and YOU have to make the actual purchase.

It can be a bit intimidating to place a order with a discount brokerage for the first time. It’s not rocket science, but there are some things to know which will make it a lot easier.

Note – This article will not cover asset allocation or how to decide which ETF or stock to buy. This article will be useful if you already know what stock or ETF you want to buy, but aren’t sure exactly how to go about making it happen. It might also convince you to stick with mutual funds. 😉

General steps:

Pick a discount brokerage. Here is my Canadian discount brokerage comparison for reference. There are a lot of different costs involved when choosing a brokerage, so make sure you understand what type of investor you will be and how big your portfolio is. You can save quite a bit of money if you pick a brokerage that suits your investment style and portfolio size.

Set up the account. This is the most painful part of the process. You have to fill out documents, mail them in, set up logins etc. It takes a while, but you only have to do it once.

Fund the account. You can’t buy anything if there isn’t any money in your account. Send a cheque, move money electronically or transfer existing stocks or ETFs from another investment account. You have to move money into the investment account where you wish to make a purchase. For example if you have an RRSP and TFSA account at a discount brokerage and you want to make a purchase in the RRSP account – move the cash into the RRSP account. I have bill payments set up for my Questrade accounts and I just have to make a payment to move money from my CIBC chequeing account.

Decide what to buy. It’s out of scope for this article, but you should have some idea of what kind of asset allocation you want, then decide which securities you want to buy.

Buy a stock or ETF. This is the topic which will be detailed here. I’ll be using the interface at Questrade discount brokerage to demonstrate how to make a trade, but whatever brokerage you use should have something similar. If you notice differences with your brokerage, please let me know and I’ll add that information to this article.

Here are the steps to buy a stock or ETF”

1) Know what security you want to buy and how much.

I’m assuming at this point, you already know what stock or ETF you want to buy. Five per cent of my portfolio is made up of real return bonds. For this allocation, I use the iShares real return ETF. I need to purchase approximately $1886 for rebalancing purposes. This will be the ETF I’m going to use for this article.

2) Find out the stock ticker symbol for the security

Every security that trades on a stock exchange will have a stock ticker symbol. This symbol will be needed to make the purchase.

There are a number of ways to find out the ticker symbol. In my case, I can go to the iShares.ca website and look it up. The ticker symbol in this case is “XRB”. Another method is to type in the name of the security into a quote site like Yahoo Finance. If I type in “iShares real return bond”, it returns the symbol “XRB.TO”.

Hmmm…so why does the iShares site say the ticker symbol is “XRB” and Yahoo says it’s “XRB.TO”? The answer is that they are both right. “XRB” is the basic symbol, but “.TO” is the extension which indicates which exchange the security trades on.

3) Find out which exchange the security trades on

There are different stock exchanges in different countries and the security you want to purchase will be traded on one or more exchanges.

If the security you wish to purchase is Canadian, it will likely be traded on the TSX (Toronto stock exchange) and you have to select that stock exchange when making the order. In the case of Questrade, you don’t select the exchange – you just include the “.TO” extension for any trades. If the security is American (such as a Vanguard ETF), you don’t need an extension – just enter the basic ticker symbol (ie VTI for the Vanguard total American stock ETF).

In my case, the iShares real return bond ETF has a ticker symbol XRB and trades on the Toronto stock exchange. I need to use “XRB.TO” when attempting any trading of this security with Questrade.

Understand that some stocks are traded on both the Toronto stock exchange as well as the New York stock exchange. If we look at Bank of Montreal, the symbol “BMO.TO” is the ticker symbol of the security that trades on the Toronto stock exchange. The symbol “BMO” is the ticker symbol of the security that trades on the New York stock exchange. Make sure you use the proper ticker symbol or select the proper exchange!

Note that other discount brokerages have their own methods of notating the exchange.

- Questrade – For TSX stocks, use the suffix “.TO” ie XRB.TO, for NYSE – use basic symbol ie XRB.

- RBC Direct and TD Waterhouse – Choose the desired exchange and then enter the basic symbol ie XRB.

- Interactive Brokers – Enter basic symbol and choose the appropriate choice from the list. Ie enter “RY” and you will see a list of exchanges.

4) Determine the currency of the security

Basically if the security trades on the Toronto stock exchange, it will be in Canadian dollars and if it’s on the New York stock exchange, it will be in US dollars.

At Questrade, if you have a registered account or a non-registered account that is not margin-eligible, you can either convert money to the proper currency before placing the order or the brokerage will convert money for you if there isn’t enough of the required currency.

If you have a non-registered margin account, Questrade will draw into margin to fund any shortfall, they won’t convert any other currency to fund the order.

Check what options are available for currency conversion at your brokerage.

Once I calculate how much money I need for a purchase, I like to convert any money necessary to make sure that there is enough of the proper currency to cover the purchase.

5) Find the security price and calculate how many shares you can buy

Unlike mutual funds which can be purchased in partial units, stocks and ETFs can only be purchased in whole shares. This means you probably can’t buy the exact dollar amount you planned, but will only be able to purchase a lessor amount with some cash left over.

Every major financial website will have a “get quotes” section where you can enter a security ticker symbol and it will tell you what price the security is trading at. This can also be done on the trading platform at your discount brokerage. I use Yahoo Finance for this purpose.

When I enter XRB.TO, I find out that the last trade was $23.12. I want to buy $1886 of XRB or as close to that amount as possible to complete my rebalancing process. To calculate how many shares I can buy, I have to divide the desired purchase amount by the share price and then drop any decimals.

$1886 (desired purchase amount) / $23.12 (share price) = 81.57439 shares. I drop all the decimals and I’m left with 81 whole shares which will cost $1,872.72 at a share price of $23,12.

If you have enough money in the account to cover, you also have the option of rounding up the number of shares to 82 shares.

Don’t forget to make sure you have enough cash to cover the trading commission when buying. The trading commission will be deducted from your cash in the account.

At this point I have the:

- Stock ticker symbol – XRB.TO

- Number of shares to buy – 81

- Approximate share price – $23.12

- Enough cash in the proper currency in my account – $1886 of Canadian bucks.

Now I know exactly what I’m buying and how many shares. I’m still not ready to place a trade, because there a few more things to cover.

6) Market order vs limit order

When placing a purchase order, you can indicate that it be placed as a “market” order or a “limit” order.

A market order means you don’t put any conditions on the price of your order. Once you place the order, the purchase will get completed (or filled) as soon as enough shares are offered on the exchange. For larger companies and high volume ETFs, this will happen instantly.

A limit order means you specify an upper limit for the price of the shares. For example my future XRB shares are trading at $23.12. If I put a purchase order with a limit of $23.05, the order won’t get filled until the market goes down a bit and someone accepts an offer of $23.05 for their XRB shares.

On the other hand, I might place a purchase order with a limit higher than the current market price – say $23.30. The reason I would do this is to avoid the possibility that trading is light and you end up buying shares at a rate above the market. This is practically impossible if you stick to liquid, high volume stocks that have many shares trading at any given time. Note that in this case, your order will still be traded at “market” as long as your limit is above the market price. So putting a limit of $23.30 does not mean I’m offering to pay $23.30 for XRB shares. It just means I won’t pay more than $23.30 for the shares.

I would strongly urge that you don’t place orders when the exchange is closed, unless you put a limit on the order.

In theory, limit orders are safer than market orders. However, I’ve completed a fair number of market orders and limit orders and never had a problem with either. My current process is to always place a limit order just to be on the safe side.

7) Log into your discount brokerage account

At this point we’re ready to log in. With Questrade, you have to log into your main account at myquestrade.com and then log in to your trading platform. Other discount brokerages will have just one login.

Before I enter the order, I want to make sure I have enough Canadian dollars to fill the order. Check with your brokerage to find out what happens if you make a purchase without enough cash in that currency.

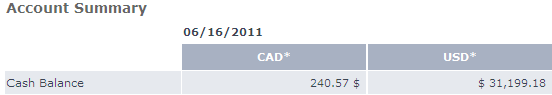

To check my Canadian cash balance, I click on the YOUR ACCOUNT tab and then “Balances”

I recently converted a lot of Canadian dollars to US dollars, so I don’t have enough for the trade. No worries, I’ll do the trade anyway and Questrade will automatically convert the proper amount of US$ to fund the order. At Questrade, this currency conversion costs 0.5% in a registered account, so you don’t want to be converting more than necessary. Other brokerages typically charge around 1.5% for currency exchange costs.

Once I’m in the account, I select MY PLATFORMS and then Login to equities platform. If this is your first time, you have to select which trading platform you want to use. I use QuestraderWeb which is the free trading platform.

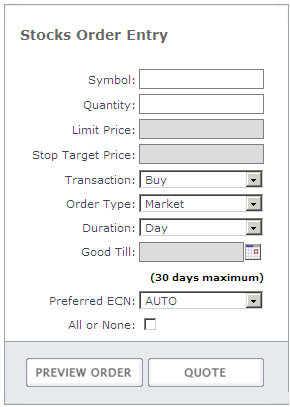

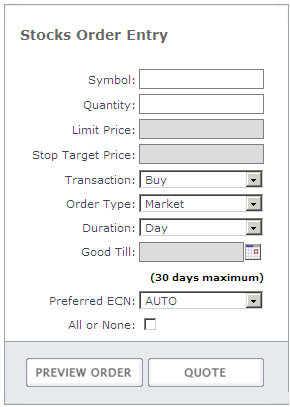

Now I choose “QUICK ORDER ENTRY”. The form on the right hand side is used to enter an order.

I’m going to break up my purchase order, so I can show one purchase with a market order and one with a limit order.

How to enter a market order

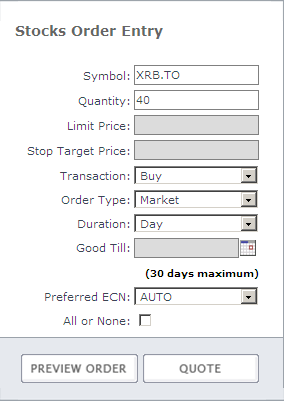

For my market order purchase I’ll fill in the fields like so:

- Symbol = XRB.TO

- Quantity = 41

- Transaction = Buy

- Order Type = Market

- Duration = Day*

- Preferred ECN = AUTO

*Duration – “Day” means that the order will only exist until the end of the trading day. If it is unfilled at that time, then it disappears.

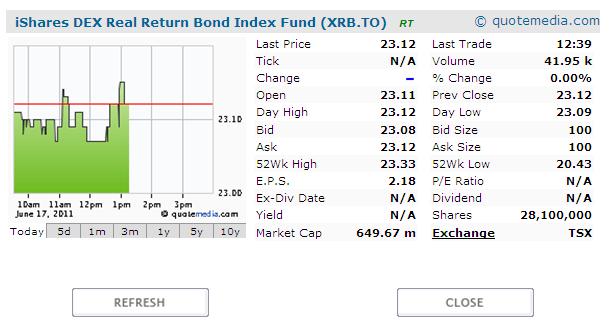

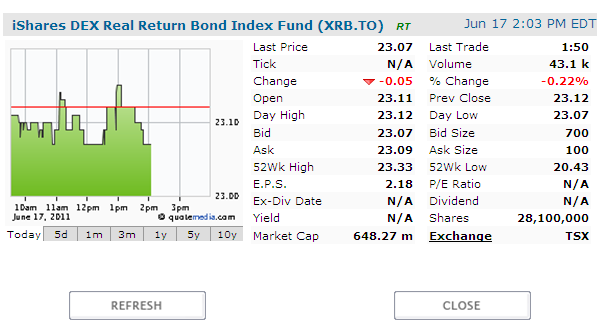

The next step is to verify the share price by clicking on the QUOTE button at the bottom of the form.

Now we see a pile of new information on the quote screen.

The main info I’m interested in is the Last Price which is $23.12. This hasn’t changed since I did my original share calculations.

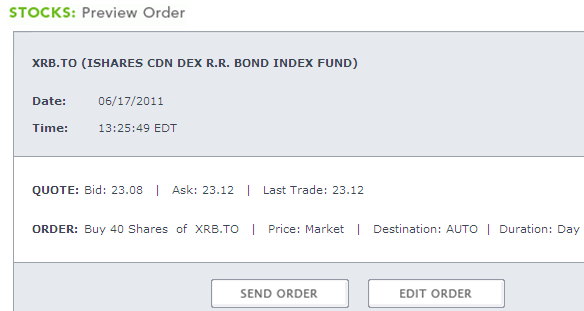

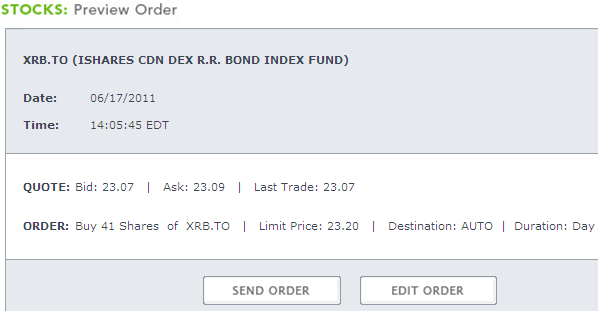

Next step is to click on PREVIEW ORDER

This is your last chance to verify the order information. Everything looks good, so now I will click on “SEND ORDER”.

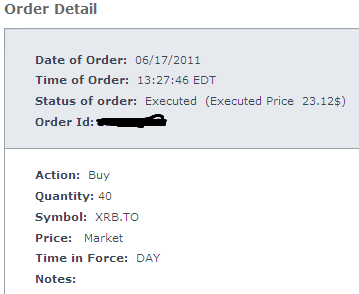

The order was filled (or executed) instantaneously at $23.12.

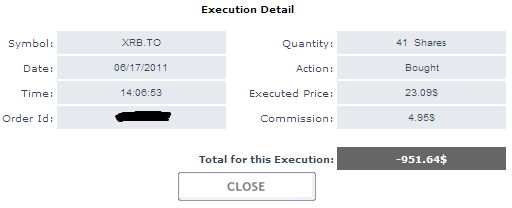

If I want to review the order details, I can go back to my main account page and check the “View Messages” and “Detail”.

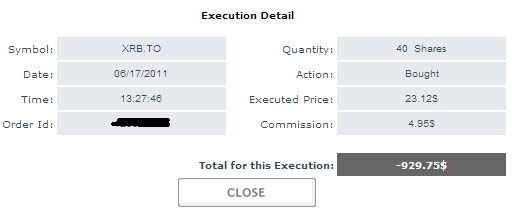

From this I can see the commission ($4.95) and the trade total of $929.75 which represents the share cost and commission.

Some brokerages (including Questrade) add another fee to the commission called ECN fees. They are fairly small, but if you are doing high volume trades, it can be a factor.

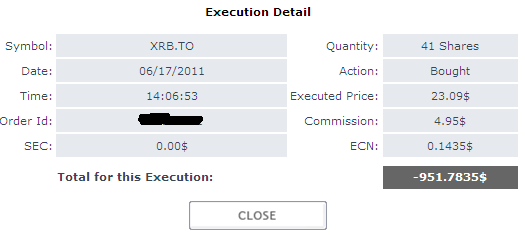

When I look at the execution detail after the business close, I see there is an ECN value which has been charged as well. The ECN costs at Questrade are $0.0035 per share for XRB. My 41 share trade has an ECN fee is 14.35 cents which brings my total cost to $5.10.

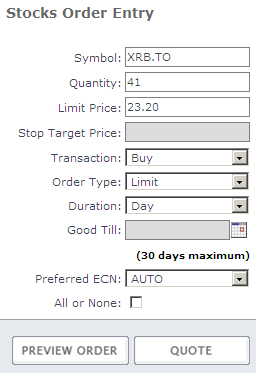

How to enter a limit order

Most of the steps for a limit order are the same as for a market order.

Start with “QUICK ORDER ENTRY”. The form on the right hand side is used to enter an order.

The key difference with a limit purchase is that I will be specifying a price which represents the highest price I’m willing to pay for the stock. In the case of XRB, the current market price is $23.12. If I select a limit that is higher than $23.12, the order will likely get filled at market (just like my market order) and the limit will just be there for protection.

Another strategy is to put a limit price that is lower than the current market price and hope that the market drops and you can buy at a lower price. In this case you will have a pending order which can be cancelled. This is a good scenario for using the “GTC” or good till cancel order type so that the order doesn’t get cancelled at the end of the day.

I like to select a limit price that is just above the market price – perhaps 1 or 2% higher. In this case I’ll try setting the limit at $23.20 which is just above the market price of $23.12. If the stock is more volatile you might have to set a higher limit because the stock could jump past the limit before you place your order.

It’s not a bad idea to monitor the price movements of a stock for a little while to get a feel for the volatility. You want to set the limit high enough about the regular price points in order for the order to get filled quickly. For example if you check the price of a stock every 60 seconds and see the following: $23.12, $23.09, $23.14, that stock price is not moving around much and you can probably set a price of $23.20 or $23.30 and be fairly assured it will be filled.

For my limit order purchase I’ll fill in the fields like so:

- Symbol = XRB.TO

- Quantity = 41

- Limit Price = $23.20 Note, you have to select the order type of “Limit” before this field becomes active.

- Transaction = Buy

- Order Type = Limit

- Duration = Day

- Preferred ECN = AUTO

The next step is to verify the share price by clicking on the QUOTE button at the bottom of the form.

Now we see a pile of new information on the quote screen.

I can see that the last price for XRB has dropped from $23.12 to $23.05.

Next step is to click on PREVIEW ORDER

This is your last chance to verify the order information. It looks good, so now I will click on “SEND ORDER”.

The order was filled (or executed) instantaneously at $23.09.

From this I can see the commission ($4.95) and the trade total of $951.64 which represents the share cost and commission.

Some suggestions

It is a bit stressful to be doing your first trade with a lot of money – I suggest starting off with a small trade or two just to get familiar with the process. Yes, you will be burning a couple of commissions, but trust me – it’s worth it.

Another suggestion is to see if your brokerage offers a “test” area where you can place dummy trades to get familiar with the trading platform. Questrade offers a free trading platform trial which you can access to try some test trades.

Another option is just to use cheap index funds – they are a heck of a lot easier!

Please let me know if you have anything to add to this information based on your experience with different brokerages.

31 replies on “How To Buy An ETF Or Stock Using A Canadian Discount Brokerage”

That is one heck of a detailed post Mike, nicely done! I agree with not placing the order after the markets are closed, you could be in for a surprise in the morning.

I also like the idea of doing a couple of test trades (if possible) rather than making a few small trades to try and learn the process. No need to pay for your mistakes if you don’t have to.

Thanks Echo!

I remember making my first ETF purchases – they were fairly large, which just added to the stress.

I should have just done a couple of test trades to get started.

Great post! I’ve known a number of people who have gotten intimidated by the mechanics of setting up an account and placing an order, this is terrific.

Wow, this is an epic post! Great work Mike.

I’m sure this is going to help many DIY investors.

This is great! I have opened accounts with both Questrade and TD Waterhouse but haven’t placed any orders yet. Am in the process of transferring out of mutual funds.

Does TD have a place where one can practice before placing orders. If someone can do an article similar to this one to show how one can navigate the TD platform it would be great!

How would you handle an order where you want to specify that all earnings are to be reinvested in the same ETF?

@Be’en – If you want to reinvest the earnings in the same ETF, that’s called dividend reinvestment. That is not part of the purchase order. Contact TD for details. I don’t know if TD has a practice trading area – you should give them a call.

@Mr. Cheap & My Own Advisor – Thanks! I really appreciate it.

Great step-by-step instructions. I use questrade too, and find it pretty simple to use… but their interface for actually tracking stocks sucks. In those instances, I shift over to google finance to track it over time. And then switch back to make trades. Not sure if you found a better way?

Thanks TSM.

What do you mean by “tracking stocks”? Like a watch list or do you mean tracking your entire portfolio?

I don’t really track anything since I only buy broad-based ETFs. Once a year I’ll add up my portfolio to measure the return.

About ECN fees, Questrade’s website says that those fees are charged for removing liquidity but not for adding liquidity. What is the difference between removing and adding liquidity to the market?

@Dominic – I don’t know. 🙂

I have ECN fees on my list of topics to research, so eventually I’ll do a post on them.

Hi I’m Maggie, I work for Questrade.

An ECN routes your order to an exchange or market. Nearly all routes charge an additional fee if a trade removes liquidity from the market.

In very general terms, if you have an open order that is pending, (waiting to be filled,) you are adding liquidity. Conversely, if you send an order that is immediately filled then you are removing liquidity. Please keep in mind that there are certain exceptions to this explanation, please see How to Avoid ECN Fees on our website under Preferred ECNs 101 – http://bit.ly/kBs6rn

I hope that helps clarify the difference between adding and removing liquidity @Dominic

For more information about adding and removing liquidity – including how to avoid ECN charges – please visit our website http://bit.ly/kBs6rn

Client Services is equipped to explain the nuances of ECN fees and liquidity beyond my general answer – you can reach them by phone, email and live chat through our website.

All the best,

Maggie Rust

Social Media Communications Specialist

Questrade Inc.

Great step-by-step guide with screen shots Mike. I have been researching all the ins and outs of using a discount brokerage for a year now, but I just don’t have the capital to make it worth it yet. When my wife starts work next year it will free up some household cash and I intend to implement a similar “index-investing” approach with index funds and ETFs. This is the best guide I have come across so far!

@Maggie – thanks for the info.

@My Uni $$ – Thanks a lot. Good luck with your investing!

This is surely one of those posts that will be a great resource for people looking to get started in investing on their own.

Great job!

Thank you SO much! I spent about an hour trying to figure out why my ticker symbol wasn’t being recognized. All I needed was the .TO and it was good to go. Thanks!

Nice article, a lot of effort. I’d like to share my perspective on one part ie the part where you review the quote right before submitting a market order. You state that the main info you’re interested in is the Last Price. The Ask price is more important as that is the price that sellers are willing to sell at. The Last Price and Ask price could be completely different numbers. The Ask price has direct impact on your upcoming trade whereas Last Price is just info on a past event.

Great information…Just getting started….Thanks Mike

Yes, great guidelines… Thx.

I have a question.

I’ve not been able to find any reference as to the impact, if any, of a stock ‘Bid Size/ Ask Size’

If for example i want to buy a 100 shares of ABC Co. would the ‘Bid Size/ Ask Size’ have any impact on my purchase?

Whether my 100 shares was greater than Bid Size/ Ask Size?

Or less than Bid Size/ Ask Size?

Thx.

Peter

Hi

I have been using Questrade for one year now, and have made the frequent mistake of not specifying .TO for CDN Stock Exchange purchases, so I own a few Canadian Bank Stocks in US dollars! I am glad I am not the only one who does this.

Your post if the most informative and helpful one I have found so far, on how to purchase stocks and ETF. I wish I had found it a year ago.

Thank you,

Deanna

One Question:

Can we now purchase ETFs from our Questrade account, without paying the initial commission fee?

Thank you.

I think I just read that on their webpage.

Cheers,

Deanna

@Deanna – Thanks. Yes, you can now buy ETFs commission-free from Questrade.

I haven’t tried it yet, but apparently you still pay the fee at purchase time and then Questrade rebates the money fairly quickly.

Very Informative!!

Has any one tried TD e-series?

Great post. I am just starting out with Questrade, but I think if I take things slowly, I’ll be able to take control of my own finances pretty soon.

One thing that has changed – currency exchanges at Questrade have gotten a little more expensive:

“Clients with total account equity (amongst all accounts) less than 100,000 will be charged a spread of 1.99% for both margin and registered accounts. Clients with total equity (amongst all accounts) more than 100,000 will be charged a spread of 1.7% for margin accounts and 1% for registered accounts.”

Maybe an article on Norbert’s Gambit is due?

Totally newbie question with regards to trading.

So the $31k in your USD or the $250 in your CAD account,

does this reflect the actual “Cash” or Money you have in your Bank account or only your QuestTrade account?

If it only reflects the actual cash in your QuestTrade account, is this actual “real” money? ie. can be transferred to your chequing / used to spend etc.. ?

Thanks for the informative post!

Please if anyone can clarify? I am totally new I apologize for the lack of knowledge in advance.

Very well detailed info.

Thanks for this write up!!! I have been stalling for months to get into the market (currently holding a savings RRSP and TFSA getting next to nothing interest)…

Investing is like a second language, and it seems like all the info out there is very vague or touches on the overall process but not the nitty gritty details of how to actually do it. This, does that. Heck, it holds our hands and walks us through it but that’s what some of us need to get started, so thanks for that.

PS Questrade does have a practice account now available for 30 days; gives you $1M to play with and get familiar with the system.

Hi,

I am planning to open an account with initial deposit of 1000.-

Can I buy stocks only for 750.- including commission?

I understand that a minimum of 250.- has to stay in the account at all time,

to keep the account open!

Regards,

Ed

Nice detailed article for helping new investors but I am confused why you paid commission on buying ETFs while Questrade does not charge commission for buying ETfs ( this is what I have read from their website and reviews on internet)

Hi There,

I am not new to investing in securities…..but not sure how the who DRIP process works.

I am aware that I need to invest a certain amount of money into a security (my preference right now is bank securities) but how do I know if a bank offers a DRIP program?

Do I need to do anything on a specific website such as RBC Direct Investing or Questrade in order to complete this process or do I need to talk to someone where I do my trading?

Thanks!

Jeff

Excellent post ! Thanks Mike. Want to start trading penny stocks on the Canadiam market. Am a UK citizen living in the UK. Anyone know a discount broker who could assist and facilitate ? Thank & Rgds Ron