I’ve been looking for some kind of software that will help me organize my bank accounts a bit. I’m not into budgeting, but I do have a small business and need to come up with several totals at tax time. I also would like to be able to see income/expense breakdowns without doing a lot of work to set them up. I thought I would try Mint.com, since they just launched the Canadian version of the software.

I’ve been looking for some kind of software that will help me organize my bank accounts a bit. I’m not into budgeting, but I do have a small business and need to come up with several totals at tax time. I also would like to be able to see income/expense breakdowns without doing a lot of work to set them up. I thought I would try Mint.com, since they just launched the Canadian version of the software.

Mint.com is a website where you can sign up for a free account and use their online budgeting software. You add your various bank accounts and Mint.com will collect all the information automatically. You can easily set up a budget or do reviews of your spending habits.

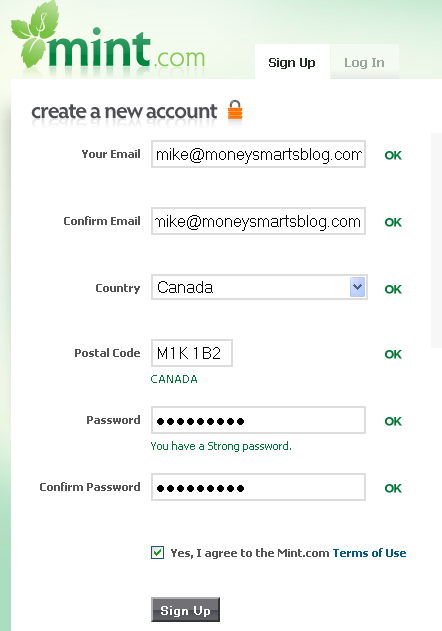

Setting up your account with Mint.com

Creating an account was very simple and very quick. It’s also free.

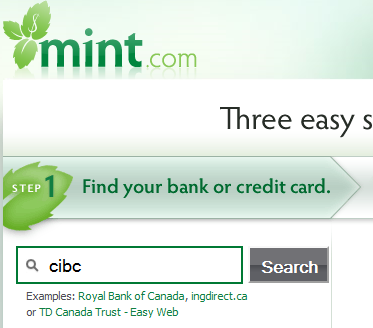

Once I had a login, I tried adding my CIBC accounts.

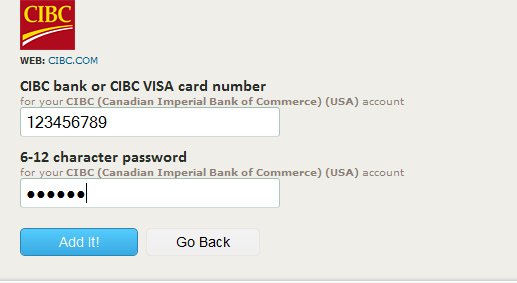

Once the financial institution is found, the next screen asks for the bank or visa card number and password.

I had no problem adding my CIBC accounts, however the first problem is that it added all my CIBC accounts – in fact I only wanted to add my personal chequing account and personal visa in one profile and then have my business visa (also with CIBC) in another profile.

I think if I were to use this software for proper budgeting, I would have to set up a labeling system to separate the personal accounts from the business accounts.

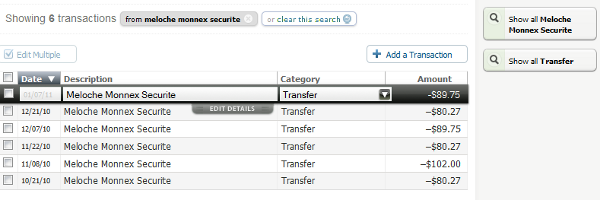

One thing I wanted to do was add up all my Enbridge gas payments. I clicked on the account and it showed all the transactions in a scroller.

One neat button is a “Show all XXX” where XXX is the transaction you have highlighted. By highlighting the last Enbridge payment and selecting the button “Show all Enbridge”, it showed all the recent Enbridge payments. This is precisely the function that I need to help me assemble my tax information.

It appeared to only show transactions from the last three months. which is not what I wanted. I did some research and unfortunately Mint.com can only pull up to three months of historical data at a time.

They do have a manual “add transaction” function, which is useless since I’m not going to spend hours adding many transactions one at a time. What they really need is a data upload function. You would download your historical transactions from your account and then upload them to Mint.com in one step.

Nonetheless, if you sign up for Mint.com and don’t delete your account – they will continue to add your data and eventually you will have a useful amount of historical data. I really like the automation involved with Mint.com and I can tell you that the interface is fantastic. My plan is to keep my account activated and then I will try it again next year (when I have enough data) to help with my 2011 taxes.

I also have a chequing account at PC Financial, which I use for my business activities. I added this account without any issues, although it also only loaded three months worth of data.

Who can use Mint.com right away?

If you are just starting a budget and want to keep track of your finances, having three months of historical information should be more than enough. You can add your accounts, categorize transactions the way you want and then budget to your heart’s content. Mint.com will automatically put all transactions into a category. These can be changed at anytime and Mint.com will “learn” from your correction for future transactions.

Other features of Mint.com

I haven’t spent a lot of time on the budgeting features, however some of the neat one are:

- Targets and notifications – You can set a maximum amount you want to spend on a particular expense and Mint.com will send you email notices if you go over budget.

- Set up a budget – Once you input your income and budget categories – Mint.com will tell you how much you should have left over for saving.

- Trends – The trends feature allows you to see spending or income for any particular category over time.

How much does Mint.com cost?

Setting up an account at Mint.com is easy and best of all – free! Keep in mind however, that Mint.com makes money from financial institutions which it recommends, ie it might recommend a “better” credit card based on your spending. If you sign up for that credit card – that company will pay money to Mint.com. I would suggest one the following strategies, when facing a recommendation from Mint.com:

- Take any recommendations with a grain of salt. You might very well benefit from their recommendation, but don’t just blindly assume that is the case.

- Ignore them completely.

Main benefits of Mint.com

- Free – Can’t beat that price.

- Automatic data download – I love this part – once you add your accounts, you never have to add any kind of data again. All automatic.

- Great interface – The interface or user screen is awesome. It looks good, it feels good and I had no problem figuring out how to do things I wanted.

Here is a quote from Red Flag Forums, which I completely agree with:

But man alive, THAT is how you design a website. It is amazing how easy it is get started with it.

Main drawback of Mint.com

- Initial historical data only goes back three months. For most people, this might not be a problem, but it is a problem for me. I’m going to remain a client and then next year I’ll have enough historical data (data for all of 2010) to be useful for my taxes.

- Can’t do data upload of historical transactions. This feature would be a reasonable work-around for the first drawback.

What about security?

I’ve been banking online for what seems like my entire adult life. At this point, I can’t honestly say I have any concerns about security or that I’m willing to do anything about them. The only difference with Mint.com, is that it assembles all of your account information in one place, rather than regular internet commerce where your info is spread around.

Realistically, if someone could hack into your computer – it wouldn’t matter whether you use Mint.com or not – all of your information will be available.

What do you think? Is Mint.com superior to desktop software packages like Quicken or You Need A Budget?

More reviews

See Mr. Cheap’s review of Mint.com.

53 replies on “Mint.com Canada Review – Online Free Budgeting Website”

It sounds like it may be a great help to someone like me who has very simple accounting needs. It is nice to get it all in one spot!

I will try this now!

Link to mint doesn’t work 🙁

Rachelle

Are you at all concerned that all this data is crossing the border and being stored on servers in a foreign country (the USA) where Canadian laws do not apply to it?

@Rachelle – Thanks, I fixed the link.

@Schultzer – That’s a good point. As it stands right now – I have my financial info with quite a few American companies, so one more doesn’t really concern me.

It is not really budgeting software – doesn’t handle all my accounts.

It would be easier to create a spreadsheet and analyze your historical transactions – more accurate.

@Steve, which accounts does it not handle? I saw your post about not being able to add Questrade.

I never tried adding a discount brokerage – I don’t see my investments as part of a potential budget.

I prefer Quicken on my own computer. First of all I control what goes in and when. Secondly, Quicken has some great budgeting features that mint.com doesn’t. I especially like (and make great use of) Quicken’s feature that allow you to enter your upcoming regular bills and paycheques, and then every time you open it, it gives you a snapshot of how much you have, how much is “committed” to these upcoming bills (i.e. utilities, savings account deposits, rent/mortage, etc) and how much is left between now and the next pay day. You can’t do that with mint.com

But all of that aside, I have BIG security issues with mint.com. Did you know that when you take out an account on mint.com, you give mint.com power of attorney for certain banking functions? That just scares me. Here’s the clause:

“For purposes of this Agreement and solely to provide the Account Information to you as part of the Service, you grant Intuit a limited power of attorney, and appoint Intuit as your attorney-in-fact and agent, to access third party sites, retrieve and use your information with the full power and authority to do and perform each thing necessary in connection with such activities, as you could do in person.”

More importantly, even though most Canadian chartered banks work with mint.com, I was told that if you give any third party person or website your account ID and passwords, your bank can consider YOU to be solely liable if there is a problem with your account, i.e., funds withdrawn without authorization, etc.

Use mint.com if you like, but do so understanding the legal implications of doing so. For my own peace of mind, I’ll stick with Quicken. Not only that, it just works better anyway, and is much, much more powerful.

Sorry – forgot to add that you also agree that the laws of California apply between mint.com and yourself (not very useful if you’re in Canada) AND that if you cancel, they will delete your account, but traces of the information could remain on their servers and could be used for other purposes. You consent to that when you sign-up. Still think mint.com is a good company to give your financial info to?

The clause is:

“When you request us to delete your account for the Service, your data will be permanently expunged from our primary production servers and further access to your account will not be possible. We will also promptly disconnect any connection we had established to your Account Information and delete all account credentials. However, portions of your data, consisting of aggregate data derived from your Account Information, may remain on our production servers indefinitely. Your data may also remain on a backup server or media. Intuit keeps these backups to ensure our continued ability to provide the Service to you in the event of malfunction or damage to our primary production servers. We also reserve the right to use any aggregated or anonymous data derived from or incorporating your personal information.”

I have found that you need to log on in order to have the information updated. It won’t update it in the background and send you notification. I really like that they try to organize and warn you but if I have to log on, that defeats the purpose a little …

I am still using Quicken for all accounting though and I won’t be changing soon.

Hi,

MAJOR, MAJOR point against Mint is that the financial institutions themselves consider Mint.com a violation of the terms of service. I specifically asked TD about it and their response was:

“As a TD Canada Trust Access Card Holder, you’ve agreed to not provide your confidential information to third parties. This would include divulging our password and Access Card number to Mint.com. So, this would include companies that try to aggregate your financial services under one roof.

We view the aggregation of services as a security issue and generally do not support it, so while you may be able to access your accounts initially, there will likely come a time when your information becomes blocked.”

While I *love* the concept behind the service, I strongly advise people to NOT USE it, unless they’re OK with the risk of being found in violation of their institution’s terms of usage.

Fernando

@Fernando Seriously!? I thought Mint worked with the financial institutions and had agreements with them to do this sort of thing. Does Mint admit anywhere that they are (or not) endorsed or authorized by your bank to connect in your name and fetch your financial information? I haven’t seen that anywhere and I would think it’s pretty important!

I commented on the same issue yesterday here. RBC made it clear to me that if I authorize any third party app to use my ID and password for online banking, I forfeit my protection under my user agreement with RBC. If money begins to go missing from your account and they see that mint.com is accessing the account (and believe me, they know — they have detailed logs containing all accesses to your accounts and by whom/how) they could tell you “tough luck”. DO YOU PEOPLE REALLY WANT TO GIVE A THIRD-PARTY WEBSITE LOCATED IN THE USA (OUT OF THE REACH OF YOUR CANADIAN COURTS) YOUR BANKING IDs AND PASSWORDS????

Do yourselves a favour and spend $50 on Quicken. You can still download your transactions to your Quicken software and you are not violating your agreement because you download the file yourself and then import the bank transaction file directly into Quicken — it doesn’t connect directly with your bank. Quicken is MUCH more powerful. And in case you’re wondering Quicken and mint.com are both owned by Intuit, so I’m not pushing one at the loss of the other.

I would NEVER give my IDs and passwords to a website to get access to my banking info, even if it’s one way, and even more so to a website that is not even in this country where Canadian privacy laws have no force and where Canadian courts have no power.

And this website and review is being a bit irresponsible by not pointing that glaring security problem and loss of protection with your bank to your attention as a reader.

For some reason my comments didn’t go through…

@schultzter – I only wish I was wrong. Furthermore, the response from Mint to a similar concern is discussed in the same RedFlags thread that Mike mentioned – here is the link to the comment – http://forums.redflagdeals.com/mint-com-now-canada-932852/7/#post12248263

It doesn’t matter how much security Mint claims to have on their servers, networks, internal processes, whatever. The risk you’re exposing yourself to is, as Adam mentioned, that your financial institution may find you in violation of your terms of service.

We could argue for ways to improve it – (banks could offer readonly passwords, for example, or enforce two-factor authentication for any transfers or …) – but the reality NOW is that using Mint is very, very, very risky. You’ve been warned.

Trying again, without the HTTP link this time…

Schultzter, I only wish I was wrong. The TD quote was verbatim from their response to me – and it looks like Adam had a similar response from RBC.

The same Red Flag deals threat that Mike mentioned also has comments on this. Follow that link to comment 95.

In the end, it doesn’t matter if Mint claims they’re secure. The reality is that using them means you’re risking your position with your financial institution (in addition to Adam’s points about storing data outside Canadian jurisdiction). To me, that is a risk very few people should accept and I wish it was spelled out more clearly both by Mint and by those who talk about it.

Fernando

While this may technically be a violation of the TOS of various banking institutions, I would be willing to bet my entire net worth it will never be invoked. To do so would be Public Relations suicide.

As to the magnitude of the security problem involved, it’s minor. Simply put, if a hacker is able to gain access to your account because of mint, it’s 99.9999% likely he could have gained access regardless. I don’t think you are taking on any ADDITIONAL risk here.

@Fernando @Adam I saw that posting on RFD, but one post on a forum isn’t exactly a great source. 🙂

I think that someone needs to get in touch with the banks and get their official word on this issue. Also, some unbiased third-parties – such as lawyers could give their opinion. Just because the banks say something, doesn’t make it true.

I don’t have the resources to investigate this issue, but I will send an email to a journalist I know and see if he or one of his colleagues is interested.

I had heard that RBC would consider it a violation of the user agreement if you gave your ID and password to a third party site. I have just today sent them an email to know exactly where they stand when it comes to mint.com. At this point I don’t even believe they authorized mint.com to aggregate their data. Most likely, mint.com uses screen scraping or other technology to gather the information for their users. Banks are very tight on their security and I just can’t believe they authorize mint.com to access their customers’ data. I will gladly post their official response to me as soon as I get it.

In the mean time if it was me I would wait until YOUR OWN bank offers an official position. If something goes wrong to protect yourself.

@Mike, thanks for the reply. The comments I posted from TD were an official response based on my inquiry, sent via the website’s Secure Message service. Come to think of it, I’m not sure I wouldn’t be in violation of TOS for reposting it. I hope not… 🙂

Bottom line is: My understanding of the official position from my bank is ‘don’t do it’. I think to do otherwise is to put myself in a risky position.

@Kyle, I can argue the point that it is more likely for my account to be scooped up in a massive breach at Mint unless I’m being targeted specifically. As for it being a PR nightmare, I’m not so sure it wouldn’t actually be a good thing for the bank – “look how seriously we take security – we want y to do your part as well”…

Thanks for the discussion so far!

I use my own budget spreadsheet that I have customized for my own purposes, which includes forecasting my income and expenses for the year.

I did try Mint just to see what all the fuss was about, but I had to set up all the different categories that I was used to and it still wouldn’t categorize things properly, which was a pain. For example, if I get gas at a Safeway or Superstore gas station, it categorizes that as “groceries”. Same if I were to get booze at Safeway liquor store. If I have to go back and change it all the time it’s not going to work for me.

One app that I tried out on my BlackBerry was PageOnce, which was basically the same thing and it would notify me by email when my balance was low or if there was a large transaction on my credit card.

@Echo – It’s hard to beat the good ol’ fashioned spreadsheet!

I think the idea behind budgeting software is to make it easier for those who aren’t addicted to spreadsheets like some of us. 😉

Thanks for the review, I have been tempted but so far sticking with Quicken for my finances. I do need more historical data than 3 months for sure.

@Mike Holman – If your journalist friend follows up and publishes an article please let us know; and if he follows up but doesn’t publish an article please ask him to do a guest post here!

CIBC has been the biggest pain in the @rse for setting up with Mint.com. Sometimes they work, sometimes they don’t, sometimes they object to Mint.com having your logon info and threaten their customers, and sometimes they leave you alone. On the other hand, I’ve had no issues with BMO or RBC accounts. In fact, the new BMO’s MoneyLogic appears to be a re-branded Mint.com ?

@Adrian – Is BMO’s MoneyLogic a rebranded Yodlee? That’s what RBC did for their my Finance Tracker. Yodlee’s business is basically providing these Personal Finance Managers for banks to integrate into their web sites. I don’t think Mint.com resells their service, they make their money referring (i.e.: advertising) their affiliates while you use their system.

Well, RBC has confirmed my suspicions:

GIVING MINT.COM OR ANY OTHER THIRD-PARTY WEBSITE YOUR RBC USER ID AND PASSWORD IS A VIOLATION OF YOUR RBC CLIENT AGREEMENT AND COULD COMPROMISE YOUR ACCOUNT. RBC WILL NOT BE HELD LIABLE FOR ANY ERRORS OR UNAUTHORIZED TRANSACTIONS THAT TAKE PLACE IF IT IS DEEMED THAT A USER HAS VIOLATED THE CLIENT AGREEMENT.

So there you have it. First a fellow poster here showed that TD Canada Trust considers this a violation of the user agreement, and now RBC does. So what this means folks is if they know that you have given mint.com your ID and password and there is ever a screw-up in your account of any kind, they will not be held liable.

It amazes me that people will whine about Facebook and lack of privacy, but willingly give their bank user ID and password to a third-party website located in another country, AND in doing so, legally agree to mint.com having power of attorney over your information. READ THE MINT.COM USER AGREEMENT. You are tossing your privacy, security and now it’s clear your LEGAL PROTECTION out the window. Not for me, sorry.

There is an off-line budgeting tool called YNAB:

https://moneysmartsblog.com/go/ynab

@schultzter – no idea which one it is, but it feels like Mint.com. Almost same layout, menus, categories, goals, etc. Will take a look at Yodlee, thx.

@Adam – Mint.com is Intuit. Most of us already trust this company with our taxes (ie. even more personal info than just bank account balances). Also, the banks should get of their high-horse and allow read-only access to basic account info so as not to expose their customers to the risk they say this presents. But you know what, they’s rather spend the profits they earn on us and provide us with half-baked solutions which provide no value unless they themselves allow aggregation of external accounts. Chicken and egg problem …

Yup, already know that mint.com = Intuit. Big difference between tax information that you choose to put online and providing a third party website with your personal bank ID and password. I don’t think the banks are on a high horse – I think they are totally concerned with the safety and security of your baking info.

I disagree that the banks should give read-only access. Why should Canada’s banks spend their money on enhancing their systems to allow a third party website, located in the USA, with completely safe access to your banking records, so that third party website can make money? If anyone needs to invest in this security and provide its users with protection, it’s mint.com. They will make the money from the ads that appear on their site — they should pay for the costs of running their service.

And the banks already to provide access – you can download your transactions yourself and import them into any spreadsheet or popular offline financial software (like Intuit’s Quicken). The difference is you don’t have to give anyone your ID and password — you download it directly yourself.

Like I’ve pointed out several times – the mint.com user agreement that you accept when you join mint.com gives them power of attorney to access your bank records. And the banks in Canada tell you that your user agreement is rendered void if you give out your ID and password to a third party. Mint.com also indicates that they can possibly use your banking info even after you cancel your mint.com account. Mint.com is not located in Canada, so Canadian laws and courts have no control over exactly what they do with your information and security. If you feel that giving up your protection is better than just spending a few bucks one time on financial software that resides on your own computer and doesn’t require you to give your passwords and ID to a third party outside of your own computer let alone you own country, then go right ahead. My objective here is to ensure that everyone is aware of exactly what the situation is, and to make sure they also understand what they’ve agreed to when they clicked on the “I accept” box when they joined mint.com.

…one more thing. A few banks in Canada offer the same service that mint.com has on their own websites, and it’s actually more powerful. I know that both BMO and RBC do. I use RBC and they have a service called myFinanceTracker. It’s virtually the same as mint.com but I think it’s even more powerful. It’s also free, and the big difference here is that it resides on the bank’s website, and you access it through your online ID and password. The same thing with no risk to your own security.

So further to the point that was made, some banks HAVE invested in giving good tools to Canadians.

OK – HERE’S THE OFFICIAL RESPONSE I JUST GOT FROM RBC. PAY ATTENTION TO THE FACT THAT THEY CONSIDER GIVING MINT.COM YOUR ID AND PASSWORD TO BE IN VIOLATION OF THE USER AGREEMENT. I hope the author of this article will edit his advice to make every reader aware of the fact that the banks don’t block it, but you’re “screwed” if there are issues and they can’t guarantee the security of your data if you do it.

– – – –

I have looked into your inquiry and have to report that RBC does not work with third party companies for access like mint.com. This being said, RBC has not blocked mint.com. If the client is having issues with mint.com they will have to contact mint.com for support.

This company is being permitted to get to your banking profile the same as other financial institutions are allowed through our “My View” account aggregation service.

If giving this company access to your banking causes you to have any problems with your banking this will be of your own doing and RBC will not take responsibility. This is due to the client agreement which you agreed to when you got your client card and the agreement you agreed to when you took the online banking. It clearly states that:

You are liable for all Losses that result from these situations:

You authorize someone else to use your Client Card and your PIN or password for online banking;

@Adam That means they’re using Cash Edge (http://www.cashedge.com/). I already use that service to import my discount broker (Qtrade), RESP (TD), and Costco Amex into my RBC Online Banking web site. Cash Edge has been around for quite some time and I’ve always used it to consolidate my financial information to RBC.

It’s interesting that although Mint.com uses the same system (Cash Edge) as RBC they can’t import my discount broker but RBC can!!!

@Adrian There’s really three companies in this space: Mint, Yodlee, and 3rd one I can’t remember. Yodlee also offers an independently hosted service like Mint.com but from what I could gather Mint.com makes their money from

adsrecommendations to help you save money. Yodlee and the other company make their money by selling their software to banks which integrate it into the bank’s own web site.Of course if you don’t have all your accounts at one bank then they may not aggregate everything – I know RBC uses Yodlee for their myFinanceTracker and they won’t aggregate my other accounts even though connected in myView (Cash Edge).

@schultzter: Yup, I also use Cash Edge through RBC for Amex and a couple of other accounts, and I’m OK with it because I have to go through the RBC site and enter my RBC password and ID. I don’t have to give it to a third party site. Having said that, the fact that RBC uses Cash Edge doesn’t remove the issue that RBC has with giving your RBC password and ID to mint.com

@Adam I totally agree with regards to giving my ID & password to mint.com. My initial concern was they’re not governed by Canadian logs, but the comments here raise a very good issue with ToS!

I wonder if the power of attorney clause is a way for clients to give their login credentials to Mint without running into problems with the bank’s third-party rules? I.e., if you’ve assigned power of attorney on “certain matters”, then are they really a third-party?

Also, I’ve found several pages (e.g., http://techcrunch.com/2009/09/18/mint-is-yodlees-youtube) explaining that mint uses Yodlee for the back-end connectivity. Apparently Yodlee stores your login credentials and then provides a read-only view to Mint’s servers.

@ae, Yes, I thought the same. However, I would have expected that Mint.com would have provided this rationale and they have not (so far). Last thing I would want to do would be to get in a legal discussion with my bank on behalf of Mint. If Mint is not able (or willing) to argue this position who am I to do so?

OK, after reading the comments and the responses from the banks, I now believe that mint.com is not working with the banks and does not necessarily have their permission to use our banking information.

But as someone who thought they did have permission, how do I fix all this? Change my password for my on-line banking? Is there anything else I should do?

@jlocicero My suggestion would be to contact your bank and indicate there has been an unintended disclosure of your password (just as if someone else had overheard you or something). I’m sure they’ll tell you to change your banking passwords NOW and probably record the case.

Remember: this is just advice you’re getting from another user on an Internet discussion. If you’re concerned, contact your bank.

It’s true that mint.com has no direct relationship with the bank or charge card companies. Mint has a relationship with Cash Edge, and Cash Edge has separate relationships with the various banks and credit card companies.

As far as the comment about giving power of attorney to mint.com and therefore it means that you have not given it to an unauthorized third party, I suspect that this type of power of attorney is very different from a true legal power of attorney, which is a very specific document.

I think mint.com has that clause in the contract to protect THEM, so that if anything happens between you and them, they can argue that you gave them the right to access your data. But that certainly does not affect the relationship between mint.com and your bank.

Finally, if you’re worried about your security and you have a mint.com account, I would recommend that simply close your mint.com account, then change your bank online password. I would not make the bank aware of this. The chances are that the person at the other end may misunderstand what you mean and it could cause problems for you in the future. Just change your password. Besides, the bank already can see the access through Cash Edge to your accounts. These accesses are kept in their logs. Banks are very, very tight and thorough when it comes to data security.

Here is my concern about Mint.com.

If I am not using Mint.com, and somehow my CIBC (or other bank) account is compromised due to no fault of my own, CIBC will do everything they can to fix the problem.

If I AM using Mint.com, and my CIBC account is compromised, odds are good that CIBC will suddenly have a “not our problem” attitude. I should not have given away my account details, so it’s not their fault.

Has anyone tried calling up the various banks and asking them if they are OK with Mint.com?

@Rob, Yes, both Adam and I (on this thread anyway) did and got similar responses from TD and RBC – in a nutshell, “using Mint.com by giving them your ID/password is a violation of our terms of service”.

Like I said earlier, I really like the Mint.com concept, but unless the financial institution clears it, I’m not using it.

@Rob – I’m pretty sure if you call your bank and ask their opinion on a competing product you’re going to get the answer you expect! I.e.: Oh my god, if you do that the Taliban will take your money to support terrorism and it will be all your fault!!!

What’s needed is an independent opinion from a an authority, like a lawyer or some in the banking security industry.

@schultzter 🙂 And worse than that, we won’t refund it!

Seriously though, there are two aspects to keep in mind here:

– The “security” aspect is about something going wrong at Mint and someone stealing money or private info. This is what Mint tries to address – and likely does a very good job at it, BTW – by having gazillion levels of security or encryption or state of the art data centers or specially designed internal processes that prevent someone from ever, ever doing something like this. Fine.

– The “contractual” aspect is that you entered into a formal relationship with your bank where you agreed to behave in a certain way, specifically not sharing credentials. If you do, the bank can claim to be free of its obligations to you, including protecting your money. While a bank may decide to honor minor discrepancies in your account out of a sense of doing good PR, I’d be surprised if they’d honor larger claims.

While I am not an authority, lawyer or in the bank security industry, I am an Information Security Professional with several years of experience in several of the areas involved here and, in my opinion, the contractual risks are much, much larger than the technical ones.

Naturally, each person makes their own decisions about what risks they choose to accept.

schultzter wrote

<>

What “competitive” product? To use mint.com, you have to have a bank account. Some Canadian banks offer a product similar to mint.com directly online, *but it’s free!*. They do not make money on it. Whether you choose to use mint.com or the bank’s product is not a factor because your bank is no further ahead one way or the other. The only reason they may prefer you to use their product is because they control access and you don’t have to give your user ID and password to a third party. The info either resides on their site, or travels through their servers and they take the risks associated with it.

<>

Well, you can waste your time with that if you like. Your user agreement clearly indicates that if you give your credentials to a third party, the bank is no longer liable. Two of us here have official responses from our banks confirming that fact. If you have the extra money and time to get a lawyer to take on the legal team at one of Canada’s chartered banks, go for it! Have fun with that one.

Sorry – let me try that again – it didn’t like my formatting…

schultzter wrote

“I’m pretty sure if you call your bank and ask their opinion on a competing product you’re going to get the answer you expect!”

What “competitive” product? To use mint.com, you have to have a bank account. Some Canadian banks offer a product similar to mint.com directly online, *but it’s free!*. They do not make money on it. Whether you choose to use mint.com or the bank’s product is not a factor because your bank is no further ahead one way or the other. The only reason they may prefer you to use their product is because they control access and you don’t have to give your user ID and password to a third party. The info either resides on their site, or travels through their servers and they take the risks associated with it.

“What’s needed is an independent opinion from a an authority, like a lawyer or some in the banking security industry.”

Well, you can waste your time with that if you like. Your user agreement clearly indicates that if you give your credentials to a third party, the bank is no longer liable. Two of us here have official responses from our banks confirming that fact. If you have the extra money and time to get a lawyer to take on the legal team at one of Canada’s chartered banks, go for it! Have fun with that one.

And I guess one more point here. If your chartered bank does exactly the same thing online and it’s free, and you are not violating your agreement, and your data stays in Canada, and you do not take on the liability, why both with mint.com anyway? Just use the free service your own bank already offers and for which you take on no additional risk.

@Adam, I agree with almost everything you posted, but I have one question: does RBC’s version (or any other bank’s really) of the similar functionality also integrate with the OTHER banks? For example: I have RBC and TD acccounts but a CIBC VISA and a Scotia RRSP. Will the RBC service also be able to access the OTHER bank’s information? If so, how does it handle the same issues as we’ve talking about with Mint.

If it doesn’t go beyond RBC’s own data, then it is not the same as Mint.

Again, I think the Mint concept is EXCELLENT. Just wish they had sorted out the contractual risks…

@Fernando:

Very good point Fernando. You can access your accounts through Cash Edge, however, RBC’s online financial management “ExpenseTracker” tool does NOT work with these accounts — only your RBC account.

So I guess my suggestion to use the bank’s site instead of mint.com may not be the best advice, as you can’t access all accounts, HOWEVER, if you do not have accounts at other institutions, it is a viable alternative, and if you do have accounts elsewhere, then do what I do and use Quicken. Again, it’s much more powerful, you can import data from all banks that have online banking, you don’t have to give out your credentials, and it’s not that expensive — about $50 on time for a great personal finance tool that offer many, many more features.

@Adam

Yes, I’ve been on Quicken since about 1996, I think (certainly before 1999). I don’t like the interface on the newer versions (I was happy with Q02 until they stopped supporting it).

For those like me with lots of accounts all over the place – from banking to investments to credit cards to RESPs to … – Mint would be amazing: no more spending time going to each web site and downloading QIF files or worse, text files or entering things manually.

Also, using Mint would also solve the issue of universal access and likely backups as well. I have workarounds in both cases, but Mint would be ideal.

So, if this contractual issue ever gets resolved – including your points about location of the data and applicable jurisdiction – I’ll jump on it. Until then…

Thank you for the insightful commentary. I recently read an article about mint.com and it just sounded too good to be true. I’m about to finish university and am trying to start off my “real life” with good budgeting habits. Unfortunately, my current system (entering all my data in spreadsheets) is a hassle, meaning I don’t really do it properly. A program like mint.com, which is free, is very attractive. Except for the whole giving away your password part… I was surprised that it was so difficult to find good reasons not to do this beyond the obvious concerns about security.

I’m looking into the desktop software options now, which ironically I had never thought about before I heard about mint.com.

I used mint and prior to that wasabe. Niether really worked well enough for me though mint was better and I guess the market took care of wesabe.

I stopped using mint and deleted my account because it had trouble reliably accessing all my accounts. This was in 2009. Perhaps the folks at YODLEE have fine tuned their OFX code by now. The deal breaker for me was mint’s simplistic budget tool. I didnt have the individual vs business problem as reported by the author. It was just too simplistic. My Excel XLS was better for me. For the past year I’ve been using YNAB even though it doesnt automcatically download anything from anywhere. I actually prefer that as its installed on my PC. What I do like about YNAB is it tracks all my daily expenses because I use a debit card for everything.