Welcome to the August 28, 2009 Edition #104 of the Carnival of Financial Planning.

The Carnival of Financial Planning takes a long-term view of personal financial planning for individuals and families. We focus on efficient and sustainable personal financial planning practices that can lead to lifetime financial security.

This edition is arranged by subject heading, so that you can browse efficiently.

Budgeting

oneadvice presents Credit Crunch: Luxuries We Won’t Say No To… posted at One Advice, saying, “Credit Crunch = Doom & gloom for frivolous spending. But there are those little luxuries which we refuse to say no to, even when money is tight…”

Dorian Wales presents The Personal Financier: Personal Finance Management: Budget vs. Net Worth posted at The Personal Financier, saying, “While it may be recommended to manage both a budget and net-worth sometimes focus leads to better results.”

Wise_Bread presents Beyond Budgeting Pocketsmith Helps You Forecast posted at Wisebread.

Susan Savering presents Personal Living Expenses posted at Family Financial Planners, saying, “When you don’t understand how much you spend and how much you save and invest, you do not have a financial plan. This dramatically increases your family’s long-term financial risk.”

KCLau presents Thoughtless Spending posted at KCLau’s Money Tips, saying, “I was surfing the web recently and an article in Yahoo finance caught my attention. The article emphasizes the need to curb spending on the miscellaneous things in daily life.”

Economics

Banker Saver presents TARP Bailout Funds: How Have Banks Used Taxpayers’ Money? posted at Banker Saver, saying, “On TARP funds and the bailout program for banks.”

Curt presents Bernanke is Crazy to Think That the Economy is on the Verge of Recovery posted at PennyJobs.com.

Super Saver presents Expecting Another Bubble posted at My Wealth Builder, saying, “Low interest rates are bound to create another bubble. Hopefully, by expecting one, I can protect our savings better that during the housing and financial crash.”

Roshawn Watson presents The Rich Get Poorer posted at Watson Inc, saying, “The implications of this recent recession have been far-reaching enough to put a big dent in American and world wealth. Both the magnitude of wealth and the number of millionaires decreased profoundly in 2008.”

Dorian Wales presents On Causality and Correlation in Economics posted at The Personal Financier, saying, “Causality is perhaps the most fundamental element of empirical evidence available to economists. However, it is also the source of many misconceptions due to its elusive nature.”

Estate Planning

Jeff Rose presents Taking Care of an Elderly Parent posted at Jeff Rose, saying, “Find of what you need to do when you have to become the parent of your parents.”

Financial Planning

Big Larry presents Is Your Attitude Impacting Your Finances? posted at Out of Debt Christian, saying, “Has the daily dose of bad economic news, political rancor and untimely celebrity deaths gotten you down? Be careful — your bad mood can translate to some poor financial decisions too.”

Dividend Tree presents Building Core Competency for Long Term Survival posted at Dividend Tree, saying, “whether it is running a business or individuals’ investment portfolio, it is important to build a core competency for long term sustainability. In my case, I focus on good quality companies that consistently pay or have potential to pay growing dividends over time.”

Patrick @ Cash Money Life presents Beyond The Latte Factor posted at Cash Money Life, saying, “5 small changes anyone can do that will have a large affect on their financial situation.”

The Smarter Wallet presents How To Build Good Credit and Clean Up Bad Credit posted at The Smarter Wallet, saying, “Here’s how to work on cleaning up your bad credit.”

Patrick @ Military Money presents Money Management Tips for the New Recruits and Recent Graduates posted at Military Finance Network, saying, “Basic money management tips for people going out into the “real world” for the first time. This article applies to new military recruits and recent college graduates.”

Bellar presents Start Your Step to Implement Personal Finances posted at Personal Finance Management & Financial Services — MyFinancialCorner.com.

The Smarter Wallet presents Credit Monitoring Services To Check Your Credit Report posted at The Smarter Wallet, saying, “What you need to know about monitoring your credit.”

Four Pillars presents Make Home Affordable Refinance Program Changes Eligibility Requirements For Easier Refinancing posted at Quest For Four Pillars, saying, “Making Home Affordable refinance program eases requirements.”

KCLau presents I achieved financial freedom at 38 posted at KCLau’s Money Tips, saying, “This post is contributed by WaiYin, a reader whom I admire very much because she achieved financial freedom at age 38! Here, she shares how she did it.”

Patrick @ Military Money presents How Much Life Insurance Do Military Members Need? posted at Military Finance Network, saying, “Military members may have different life insurance needs than civilians. Here is information regarding how much life insurance military members should buy, and some resources for finding the best life insurance deals.”

Susan Savering presents Personal Investment Strategy posted at Family Financial Planner, saying, “When pursuing optimal financial planning and investing strategies and controlling your costs and capital gains taxes, you also need to establish a time-efficient system to monitor, adjust, and adhere to your financial plan.”

Big Cajun Man presents Mid-Year Personal Finance Check Up posted at Canadian Personal Finance Blog, saying, “Mid year is a good time to go over your plan for the year to see how well you are doing, so do it now!”

Financing a Home

Doug Boude presents Buying a New Home is EASY! posted at Doug Boude (rhymes with ‘loud’), saying, “My wife and I will be completing the process of purchasing a new home tomorrow. I summarized our experience, with tips and ideas, to help encourage others to invest in their own home as well.”

Tallahassee Real Estate presents Consider Paying Home Mortgage Discount Points posted at Tallahassee Real Estate Blog, saying, “When it comes to comparing interest rates for a mortgage loan, home buyers often have the option of choosing a loan with a lower interest rate by paying discount points. Simply put, discount points are fees charged by the lender to reduce (discount) the interest rate charged to the borrower. Paying points may seem attractive, because a lower interest rate means smaller monthly payments. But is paying points always a good idea?”

Alex Fotopoulos presents When is it Smart to Refinance a Mortgage? posted at My Trader’s Journal, saying, “Some key points to consider when refinancing your home.”

Financing Education

Buck Weber presents Does a Financial Education Matter? posted at The Buck List, saying, “With so many opportunities to learn how to get it right, why do so many of us screw up our finances so badly?”

Praveen presents Students Beware! Colleges, Tuition, Loans, and Debt – Will Education Follow the Housing Bust? posted at My Simple Trading System, saying, “Tips for students to avoid excessive loans and debt”

Income

nissim ziv presents Finding a Job: How to find a job Online posted at Job Interview Guide, saying, “This article provides a beginner guide for finding a job and the basic information on how to find a job online using social media sites, online job search engines and other job portals.”

Tyler Tervooren presents Create Your Own Green Collar Career posted at Frugally Green, saying, “Sick of your daily grind? Looking to start something new? It doesn’t matter if you’re an entrepreneur or an employee. Take the skills you already have, mix in your passion for the environment, add a little creativity and you’ve got a leg up on your new pursuit.”

FMF presents Outsourcing Chores Could Be a Good Investment posted at Free Money Finance, saying, “Time equals money. Sometimes it’s a good deal to spend money to gain time.”

Praveen presents Easy Ways to Generate Cash posted at My Simple Trading System, saying, “Easy ways to generate extra cash”

Investing

Dividend Growth Investor presents 13 dividend stocks to enter on dips posted at Dividend Growth Investor.

Dan at Everydayfinance presents Option Hedge Strategy: 2 by 1 Put Spread is Cheap and Effective posted at Everyday Finance, saying, “This article provides a low-cost way to hedge the recent rapid runup in the stock market by using a ratio spread, which can return over 2000% with a nominal cash outlay.”

Praveen presents India Fund (IFN) Trade Example posted at My Simple Trading System, saying, “An example of how having a trading system gives you an edge, and let’s you take advantage of market moves outside of your control.”

Dividend Tree presents What is your preference – Aristocrats or Achievers? | Dividend Tree posted at Dividend Tree, saying, “The key question here is; are we willing to invest in companies that have still not completed 25 years of dividend growth? All dividend aristocrats were at that stage at some point in time.”

The Skilled Investor presents Personal Investing posted at Personal Investment Manager, saying, “Investors more easily understand investment costs that are directly measurable, such as fees deducted on investment statements. However, many investors ignore or are unaware of the opportunity costs of their sub-optimal investment behaviors. Opportunity costs are usually much more difficult to measure directly, but these investment costs can be even higher than more visible investment fees.”

Jae Jun presents Warren Buffett Stock Pick Portfolio | Old School Value posted at Old School Value, saying, “A look at the intrinsic value and stock holdings of Berkshire Hathaway run by Warren Buffett. Graphs and fair value estimates included.”

Silicon Valley Blogger presents Online Discount Brokers: SmartMoney Broker Survey posted at The Digerati Life, saying, “I list some great online discount brokers for your investment needs. The list is based on Smart Money’s broker survey.”

Investing Toolkit presents Why Should I Start Investing? posted at Investing Toolkit, saying, “Why we should start investing as soon as we can.”

20smoney presents Could You Retire Off Investing In China? posted at 20s Money, saying, “A look at why we should definitely consider investing in China as a long term investment.”

Jimmy Atkinson presents Talking ETFs, China, and Intellectual Property With Claymore’s Christian Magoon posted at ETF Database.

Zach Scheidt presents Lululemon Athletica – Alarming Trends posted at ZachStocks, saying, “Lululemon Athletica (LULU) has rebounded nicely from the March low. While the niche apparel company has a strong product line and has expanded the number of stores, its same store sales figures along with inventory levels raise concern.”

Aussie Investor presents Shares To Buy Now And For The Long Term posted at Australian Investing, saying, “With investors the world over having suffered through the global financial crisis, some are now wondering how best to restore the health of their share portfolios. This article discusses some of the factors I consider when looking for the best shares to invest in. By maintaining this disciplined approach investors should end up with a portfolio of good investments to see them through these troubled financial times.”

Retirement Savior presents The Best Long Term ETFs and Mutual Funds posted at Retirement Savior, saying, “The high-growth days of the US are over. Look overseas and to other continents for your investment gains.”

Dividends4Life presents Two Dividend Stocks Rewarding Patient Investors posted at Dividends Value, saying, “Life isn’t linear and neither is investing. There are always bumps in the road and before we reach the next level sometimes we must toil longer than we like at the current level. Case in point, 2 companies’ investors have waited six quarters for a dividend increase and this past week their patience was rewarded.”

Zach Scheidt presents FDIC Backs off Slightly – PE Firms to Buy Troubled Banks posted at ZachStocks, saying, “The FDIC approved guidelines for private equity firms to purchase failed banks. While the proposal was controversial when issued last month, the balance appears to be in place to offer PE firms an opportunity for profit, while still encouraging a more stable financial environment”

Frank Vertin presents Best Index Fund posted at Best Index Fund, saying, “Buying an S&P 500 index fund through an investment counselor can substantially increase your initial purchasing costs and and drive up your annual management expense fees. Unfortunately, the vast majority of individual investors buy mutual funds and ETFs through brokers and investment advisers. Rarely do financial advisors recommend that you buy index funds with low fees. This is because low cost, no load mutual funds do not pay them as well as loaded, high fee mutual funds.”

Investing School presents What the Heck is an Asset? posted at Investing School, saying, “We always use the term but what is it really? Here’s a brief explanation.”

Tomas Escent presents Quant Finance posted at Nerds on Wall Street, saying, “Think of this book as sort of a Hitchhiker’s Guide to Wired Markets. There are no robots parking cars for six million years, but there are robots trading millions of shares in six milliseconds, so maybe that’s close enough.”ABC presents Different Types of Stock Market Indexes posted at ABCs of Investing, saying, “How different types of stock market indexes work.”

Tushar Mathur presents Can’t Control the Markets? Try controlling the Costs posted at Everything Finance, saying, “As 2008 proved, the financial markets are prone to unpredictable periods of turbulence. That can make investing feel a bit like a roller-coaster ride. The disappointing results that many mutual funds posted in 2008 and at the outset of 2009 may have left you feeling concerned over your financial future. You’re not alone.”ABC presents Investment Real Return posted at ABCs of Investing, saying, “A simple explanation of investment real return.”

Larry Russell presents Best No Load Mutual Fund posted at No Load Mutual Funds, saying, “Taken as a whole, the vast body of investment research studies show that there really are better approaches to buying and owning mutual funds and ETFs. You do not need to frantically chase fund performance. Performance chasing simply does not work.”

Managing Debt

Ray @ Financial Highway presents Dealing with Collection Agencies- Tips on Handling Collection Agencies posted at Financial Highway, saying, “Sometimes bad things happen to good people and find ourselves fighting with collection agencies. Here are some tips on how to deal with Collection Agencies.”

CreditCardAssist presents Credit Card Reform – How It Will Help You posted at Credit Card Assist, saying, “How the new reform legislation will benefit consumers and use of their credit cards after the new law takes effect.”

MoneyNing presents AnnualCreditReport.com For Free Credit Reports posted at Money Ning, saying, “AnnualCreditReport.com should be the only way to get a free credit report.”

Master Your Card presents Getting Your (Actually) Free Credit Report from SmartCredit.com posted at Master Your Card, saying, “A handy method for getting a free credit report once you’ve used up your three free reports from the government.”

The Dough Roller presents List of Low Interest Credit Cards posted at The Dough Roller, saying, “while credit card companies have a reputation of charging exorbitant interest rates, the truth is that many cards come with modest, single-digit APRs.”

Roshawn Watson presents Outrageous Law Transfers Parents’ Debt To YOU posted at Watson Inc, saying, “With few exceptions, such as a divorce decree, you are not legally liable for debts you have not personally signed for or agreed to pay. There is an inherent sense of fairness to this principle: your finances cannot be obligated to pay for something without your consent (except perhaps to the taxman or to your dependents). However, an archaic law in Pennsylvania is being enforced to make adult children to pay for their parents’ debts.”

Miscellaneous

MoneyNing presents How to Get Out of a Rut and Out of a Slump posted at Money Ning, saying, “Ever in a rut? Here’s how to get out.”

Four Pillars presents 2009 Cash For Clunkers Program – Trade In Your Old Junker For Money posted at Quest For Four Pillars, saying, “A comprehensive look at the new Cash for Clunkers trade-in program.”

No Load Bonds presents Bond Index Funds posted at Bond Index Fund, saying, “Simply put, if you pay higher bond mutual fund fees, then these bond management expenses tend just to be a deadweight loss to you. The best bond fund buying strategy is to pick only very low-cost no load bond funds.”

Retirement Planning

PT presents 403(b) Rollover to a Traditional IRA posted at Prime Time Money, saying, “My 403b Rollover”

Jeff Rose presents Can You Rollover Your 401k to a Roth IRA? posted at Jeff Rose.

Top Stock Index Funds presents Stock Index Funds posted at Top 10 Index Fund, saying, “Buy these top 10 very low cost no load S&P 500 index mutual funds directly. You do not have to pay the heavy added expenses of buying through a stock broker, financial adviser, investment adviser, or investment counselor.”

Barry presents Retirement Planning: Can You Make Do With Less? posted at Associate Money.

Lisa Moren Bromma presents Reinvent Your IRA posted at Wise Women Investor, saying, “Reinvent your IRA and learn to take control of your financial future by learning about the benefits of a self-directed retirement plan.”

Jeff Rose presents Using a Roth IRA to Maximize Your Wealth posted at Jeff Rose.

Super Saver presents A Gift of Retirement Funds posted at My Wealth Builder, saying, “A relatively small lump sum investment of $10,000 can lead to a significant sized nest egg at retirement.”

Risk Management and Insurance

Patrick @ Military Money presents COBRA Benefits Subsidy in the 2009 Economic Stimulus Recovery Act posted at Military Finance Network, saying, “The 2009 Economic Stimulus Plan includes additional COBRA and unemployment benefits.”

Savings

jim presents Wachovia Bank CD Rates posted at Blueprint for Financial Prosperity.

Tom Drake presents How Much Do You Need To Retire? The Rule Of 20 | MapleMoney posted at MapleMoney, saying, “While the 4% rule has become a standard quick calculation for retirement planning, there is a new rule that is similar, The Rule of 20.”

FMF presents Do You Shop Less to Save Money? posted at Free Money Finance, saying, “A simple way to potentially save a bundle.”

Taxes

Jeff Rose presents IRS is My Hero: The Heroes Earnings Assistance and Relief Tax Act (the HEART or Heroes Act) posted at Jeff Rose.

That concludes this edition. Submit your blog article to the next edition of Carnival of Financial Planning using our carnival submission form. Past posts and future hosts can be found on our blog carnival index page.

Technorati tags: carnival of financial planning, blog carnival.

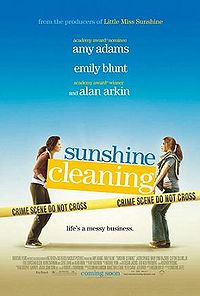

Over the weekend I watched, and enjoyed, “

Over the weekend I watched, and enjoyed, “