Eaton’s was a famous Canadian department store which was famous for it’s catalog, being a pioneer in having a “no haggling” policy and for its slogan “Goods Satisfactory or Money Refunded.” Combined with the Eaton’s reputation, this provided a powerful guarantee to customers: either they’d be satisfied with a purchase, or they would get their money back. It showed great confidence, on the part of Eaton’s, that they could deliver goods as advertised (and allow the customer to be the judge).

In “The Four Hour Work Week” Tim Ferriss discusses how he finds it hard to market with a “money-back guarantee” (saying that customers have become too used to it) and instead offers a “Lose-Win Guarantee” which is that not only will he refund money, but he’ll give a 10% bonus if someone requests a refund. He explains the money-back guarantee being dead as people don’t want to have to spend an afternoon at the post office and that risk elimination isn’t enough.

I don’t think this is the reason money back guarantees don’t work.

It seems like EVERY infomercial offered on television, EVERY over-priced seminar or “boot camp” and EVERY scam posted in the classifieds, on a lamp post or bulletin boards offers a money back guarantee. They can easily offer this guarantee: if they’re prepared to lie about their product, why not lie about a fake guarantee? Ripoff Report has 8,430 hits (as of writing) on the term “money back guarantee“. I feel for some of the posts, where they say “they have a money back guarantee, I asked for my money back, and they WOULDN’T GIVE IT TO ME!!!” Sadly, for people willing to mislead consumers about their products or services, lying about a guarantee is pretty easy. They’re also experts at making sure you can’t cancel credit card transactions (one trick is to get you to sign a contract, even for a product, then the credit card company can’t do a chargeback). A guarantee is only as good as the person or company offering it.

This wacky business idea is fairly straightforward, you set up a business that sells its reputation to honest small vendors who actually want to offer a money-back guarantee (or any variant on it). For a flat-rate (or portion of the transaction), you provide the ordering services (phone, website or whatever) for the vendor, collect the money and hold it for a set “money back guarantee” period. At the end of that period, if the customer hasn’t complained, you pass the funds on to the merchant. If the customer complains during that period, you give the money back to them. It’s like a very easy to use escrow service.

In order to gain (and build) consumer confidence, the company would require vendors to conform to set structures. For example, the vendor couldn’t create complex return procedures to prevent return of goods, or very short return periods so customers would be out of the return period before the received the goods. If the company found a vendor was getting an unusual number of complaints or returns, they would suspend selling for them until the problems were investigated and remedied.

Customers would use a single point of contact (one website and one phone number) so they’d always know they were dealing with the real escrow company. Orders would always be recorded (including audio recording of all calls), and this transaction history could be made available, with the consent of the customer, in cases of dispute. If someone was complaining about the escrow company mishandling things, they could say “do we have your permission to post details of the transaction and show that you were told about limitations or time limits?”.

Vendors would have their “terms of sale” vetted, and made to conform to a standard, straightforward agreement (that would always be presented to the customer at time of purchase). Any terms that tended to be confusing to large numbers of customers would be removed from current agreements and not used in future agreements. For example, if customers would be required to package and ship items back to the company for a refund, the escrow company would tell them this (and provide an estimate on shipping costs) at time of purchase

The escrow company could also be hired by the customer, so they could go to a company and say “I want to order your goods and pay through this escrow company, I’ll pay the extra fee”. If the vendor consented, the buyer would then get the standard protections (and the vendor would be paid after the set period). Vendors could also offer goods with and without the escrow protection (with different prices).

I’m aware of E*Bay’s trusted partner Escrow.com, and this would be something along the same lines, but not just for online purchases. You could use it for mail order, for phone orders, or for face-to-face transactions (like hiring a contractor to redo your kitchen). Amazon does something half-way along these lines where they force customers to directly deal with vendors who sell through Amazon, rather than with Amazon themselves. However, they say “You should be able to reach an amicable agreement with one another“, which I HOPE implies they’ve evaluated all vendors.

Obviously, once you’d done a few transactions with a company / person you could drop the escrow intermediary and deal directly. The escrow company would just be there for transactions that you don’t know person or company (and would let customers deal with the escrow company, a company they WOULD know well, instead).

The trickiest part of this would be growing to be a well-known standard that people have heard of and trust (this would be very challenging at the beginning). The company is selling its reputation, so building this would be the core of what they do. Partnering with (or growing out of) established large companies like E*Bay, Amazon or Paypal would probably be a worthwhile way to “jump start” such an enterprise.

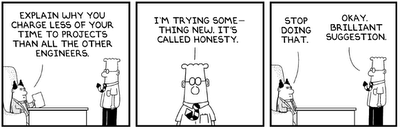

When you’re working with hard-core hackers, chances are they’ll understand what they’re working on FAR better than you do. Many people used to a traditional management role will be bothered by this. It means that you’ll have to ask questions and gather information from the techies working for you, instead of dictating things to them. Say they estimate it’ll take two weeks and you demand it be done in one? You’re going to have problems (if they *DO* deliver it in a week, I guarantee either it won’t work properly or your team will have killed themselves to meet the deadline, they can only do that so often). Say they recommend designing things one way and you demand they do it another? Chances are there are going to be unforseen (by you) problems with the design that could have been avoided by talking to the people implementing it.

When you’re working with hard-core hackers, chances are they’ll understand what they’re working on FAR better than you do. Many people used to a traditional management role will be bothered by this. It means that you’ll have to ask questions and gather information from the techies working for you, instead of dictating things to them. Say they estimate it’ll take two weeks and you demand it be done in one? You’re going to have problems (if they *DO* deliver it in a week, I guarantee either it won’t work properly or your team will have killed themselves to meet the deadline, they can only do that so often). Say they recommend designing things one way and you demand they do it another? Chances are there are going to be unforseen (by you) problems with the design that could have been avoided by talking to the people implementing it.